Struggling with time-consuming reports? Discover how reporting automation software can streamline workflows, boost accuracy and help your team meet tight deadlines. Learn the key benefits and how to choose the right tool for your team this year.

Reporting Automation: Key Overview

What is Reporting Automation?

Reporting automation is the process of using technology to increase efficiency and reduce the manual workload of report creation.

Automated reporting tools can streamline information retrieval across various data sets, and can aid the creation of final deliverables with helpful formatting and proofing features.

Reporting automation is a game changer for organizations looking for strategic productivity enhancement.

Reporting Automation vs Manual Financial Reporting

Financial reporting without the support of an automation tool involves updating data points manually every time the main dataset changes, plus spending hours perfecting formatting on reports that range up to 100 pages. It is time-consuming and more prone to human error. This method can lead to inconsistencies and delays, requiring finance professionals to spend more time on repetitive tasks and less on strategic decision-making.

Automated reporting uses software to handle data collection, analysis, visualization, and presentation. It ensures accuracy and consistency, reduces errors, and speeds up the end-to-end reporting process for your teams. This allows finance professionals to focus more on strategic tasks and provides real-time insights, making their reports more timely and reliable.

Who Should Use a Reporting Automation Solution?

Reporting automation is most useful for anyone who needs to report key information back to their clients or internal stakeholders on a regular basis.

Some of the departments that benefit the most from a report automation solution include corporate finance, FP&A and controlling teams, as well as marketing and sales.

Finance departments, for example, can use reporting automation to keep financial reports up-to-date and error-free, as well regulatory and legally compliant.

Across the financial services industry, reporting automation has a range of applications depending on the sector:

Investment Banking

Investment bankers might embark on a reporting automation strategy to export market data from data providers, such as Bloomberg, to their pitchbooks. With quality and accuracy paramount, they prefer solutions that automate the formatting of their deliverables as well.

Financial Advisory

Advisory teams require error-proof accuracy when pulling through key figures for their due diligence reports. Reporting automation provides an extra guarantee of accuracy to mitigate any risk for their clients.

Asset Management

When assessing clients’ portfolios, asset managers use reporting automation to link their data sources to their final reports in PowerPoint or Word. This way, as their portfolios grow month-on-month, they can simply refresh the data links instead of manually updating each table and chart.

UpSlide should result in shorter working hours, or at least more productive ones. Our teams are happier when they’re being productive, doing high-value work and learning, instead of formatting and copy-pasting.

Muge Mentes

Head of CEEMEA Debt Origination

What Are the Benefits of Automated Reporting?

Automated reporting tools can significantly improve your workflows, whether you’re through complex data or creating visually appealing presentations. The technology can be applied across departments and roles, bringing enormous benefits right across the board.

Here are six benefits that a solid reporting automation strategy can bring to your organization:

1. Increased Efficiency

Without reporting automation, employees would have to spend hours manually updating data points in their recurring reports, or building report templates from scratch.

Automated reporting tools can seamlessly export and update large volumes of data, provide employees with access to best-practice templates, and ensure that the final data is presented all within your company’s brand guidelines.

In saving time on these manual tasks in the reporting process, reporting teams can free up capacity for analysis and even more report creation.

2. Reduced Risk of Human Error

Human error is a challenge in any manual report generation process, whether through forgotten updates to key slides, missed figures, or simple typos. Reporting automation minimizes this risk by reducing the human intervention required for accurate data collation.

For example, a reporting automation tool allows you to link your Excel or Power BI data to your final deliverable with ease. Whenever the source data changes, the ability to reliably update the final deliverable in one click removes the stress and ambiguity typical of manual reporting.

Throughout multiple iterations of a report, an automation tool can help you reduce discrepancies and enhance overall output quality.

3. Effortless Brand Consistency

When it comes to creating an impactful report, consistency is key. Automating your report generation process enables you to rely on the accuracy of the data you’re presenting and trust that your report will always conform to your company’s brand guidelines.

Some tools offer pre-built reporting templates to ensure your data is well-presented and on-brand. Solutions might also automate the formatting and presentation of your data, guaranteeing brand consistency across a deliverable and saving you time better spent on commentary and analysis.

4. Improved Employee Satisfaction

Though some industries view manual work as a rite of passage, for many employees, it’s still the source of disillusionment and high attrition rates. Leveraging automation can significantly reduce the time spent on manual tasks, providing employees with more time for greater value-added tasks – such as analysis and networking.

Plus, reporting automation will also provide employees with better access to important information, reducing knowledge roadblocks and spurring results across different teams.

5. Greater Client Retention

In industries like financial services where clients expect high-quality, accurate reports, automating your report creation process can give you a competitive edge. Delivering consistent, impactful reports builds brand reputation with your clients, ultimately boosting long-term retention.

Using UpSlide enables Colliers to create quality valuation reports in a timely manner, allowing us to focus more on our business and clients’ needs. Now we can produce even more reports, which ultimately helps increase revenue.

Jennifer Bailey

Operations Manager, Valuation Advisory Services

6. Greater Profits and Lower Operational Cost

A significant advantage of using automated reports is the financial savings. According to a study by Accenture, innovations like reporting automation could save businesses up to $8 trillion, globally. Automated reporting tools can save individual employees up to 33 hours per month otherwise spent manually crafting reports—be that linking large datasets to a PowerPoint or Word document, or formatting charts and infographics—cutting significant labor costs in the process.

How to Choose the Best Reporting Automation Software

Here are four areas to focus on as you start exploring solutions:

1. Compatibility With Your Tech Stack

Consider which applications have already been deployed across your organization, and which ones you want to connect to optimize your reporting workflows.

There are many reporting tools, for example, to automate workflows between Excel and PowerPoint. However, if your team is regularly building reports from data in Power BI, you might want to explore a more specialized solution.

Likewise, if your organization works predominantly in Microsoft 365, you might want to consider a Microsoft Partner for your reporting automation solution to ensure full alignment with Microsoft’s future product roadmap.

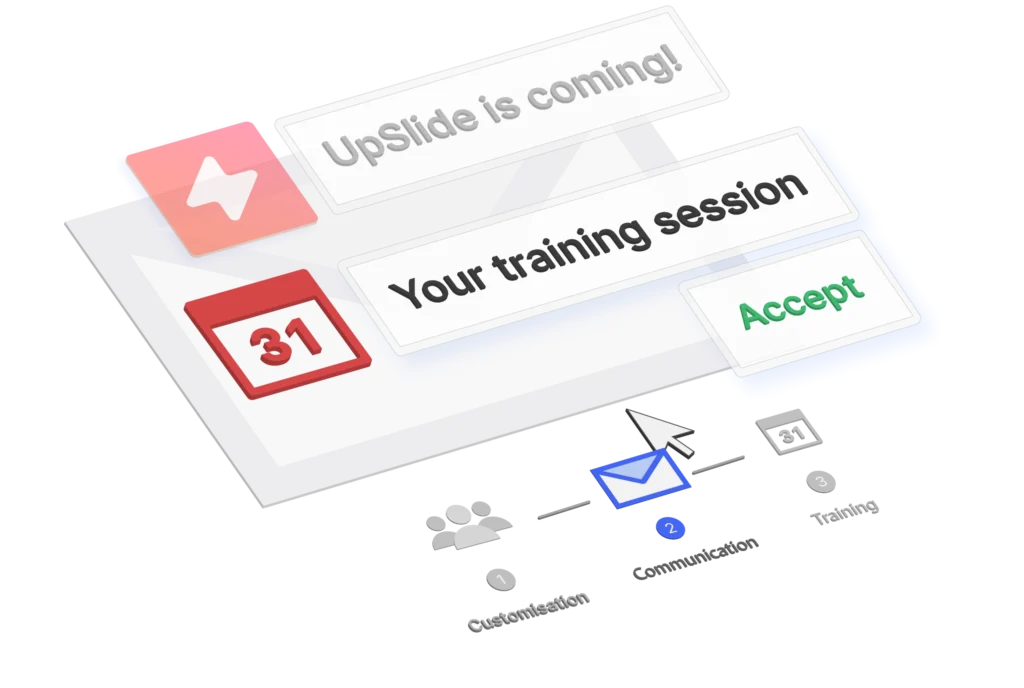

2. Onboarding Employees

As with any significant change, transitioning from manual to automated reporting may be met with resistance from some employees due to a lack of familiarity.

The key here lies in effective communication around the benefits of the solution, such as alleviating mundane tasks, and saving time for higher-value-added work.

Implementing a clear project timeline and adoption plan is also advised to ensure your employees are fully trained on the new tool as efficiently as possible.

3. Budget

There are many reporting automation solutions out there; however, we recommend conducting a cost analysis for a range of solutions to understand which one best suits your budget and needs.

A more premium solution may require more costs upfront, but will typically come with advanced features and support to help ensure higher adoption and long-term ROI.

4. Security and Compliance

Automating reports undoubtedly enhances productivity and efficiency, but it also presents additional risks associated with data security. When dealing with key financial data specific to your or your clients’ organizations, it’s imperative to use an automation solution that protects that data.

Before deploying any reporting automation solution, we recommend evaluating the encryption methodologies employed, and whether the software operates within a compliance framework such as SOC2.

Post-deployment, it’s also important to monitor and regulate the data permissions around your reporting automation software to establish who can interact with what data and when.

A proactive approach towards protecting your company’s confidential information is instrumental during implementation.

How Thales Use Reporting Automation Tools to Improve Their Analysis

Thales, a leading defense and logistics company, wanted a solution to help their Procurement BI team deliver the best-quality data to decision-making teams as quickly as possible. An average decision report would be filled with a diverse range of data, from supplier agreements and invoices to payment defaults and income statements.

Since adopting reporting automation into their workflows, Thales has seen significant improvements to their data reliability, the quality of their analysis, and overall work satisfaction across the Procurement BI team.

How Colliers Adopted Investment Reporting Automation to Boost Productivity Company-Wide

Global real estate and investment management firm, Colliers, has been using reporting automation since 2020 across their Valuation and Advisory team. In that time, they’ve seen time savings of over six hours per valuations report, enabling their staff to focus more on the quality of their output, and on the satisfaction of their clients.

Key Takeaways: the Impact of Automated Reporting

Manual reporting is time-consuming and prone to errors. By automating the process, businesses can enhance efficiency, reduce human error, and ensure data consistency.

With reporting automation, teams spend less time on repetitive tasks and more on strategic analysis, ultimately improving decision-making and client satisfaction.

As more organizations adopt these solutions, automated reporting is no longer a nice-to-have in financial services – it’s a necessity.

If you’re ready to transform your team’s workflows, start by exploring the best financial reporting solutions and boost efficiency across the board.

TL;DR

Manual reporting is inefficient: It consumes valuable time, increases the risk of errors, and can lead to inconsistent branding

Automation enhances accuracy and efficiency: Automating reports reduces human error, ensures data consistency, and frees up teams for higher-value tasks.

Adopting the right software is key: Choosing the right reporting automation tool, like UpSlide, can streamline workflows, improve decision-making, and give businesses a competitive edge.