Tired of manual data embedding and endless rounds of reviews? Learn everything you need to know about creating better proposals with pitchbook automation, from key benefits and workflows to choosing the right tool.

Understanding Pitchbook Automation

Pitchbook automation has become an essential workflow solution for fund managers, investment bankers, and other financial services professionals alike. But what exactly does it mean?

What is Pitchbook Automation?

Pitchbook automation refers to using technology that speeds up the pitchbook creation process with significantly less human intervention. Leveraging automation enables financial services to produce higher quality, tailored proposals in a fraction of the time it would take manually. Both fund pitchbooks and investment banking proposal decks can be automated.

Benefits of Automating Pitchbook Creation

Automation reduces the risk of human error, ensures brand-compliant decks, and frees up your team’s time, which can be reallocated into higher-value work (such as nurturing client relationships and strategic analysis).

Let’s dive deeper into each of these benefits.

Save Hours and Add More Value to Pitches

Automating pitchbooks reduces the risk of human error, requires fewer rounds of reviews, and guarantees compliance. This gives you more time to focus on value-added work, such as transforming your pitches into attention-grabbing stories fully customized to the client’s needs.

Top tip

Storytelling is scientifically proven to capture attention, hold it and create an emotional connection with your audience. Use storytelling to captivate even the most data-driven investor.

On average, automating pitchbook creation saves each employee eight hours of time per month!

Better Nurture Prospects with Consistent Branding

Automating pitchbooks makes it easier to create brand-compliant proposals. Consistent visuals, including logos, charts and tables, make your pitchbooks instantly recognizable to clients. This reinforces your brand and communicates professionalism and attention to detail.

Perfectly assembled, error-free pitches build trust, nurture relationships and guide prospects through the procurement cycle, making it easier to ultimately close the deal.

Consistent branding helps persuade prospects about your services’ authenticity, professionalism and credibility.

Giorgia Guantario

Head of Growth Marketing, UpSlide

Maximize Impact with Flawless Decks

Concise slides with clear, professional pitchbook elements will help your prospect better understand and retain your message.

Automation makes it easier to:

- Ensure accessible slides with improved design: Without a standardized, pre-approved set of slides, teams are at risk of using slides with poor color contrasts or random fonts, creating inaccessible slides that are hard to read. A content library makes it easy for teams to access standardized templates for every scenario, resulting in consistent pitches that are accessible and user-friendly.

- Present accurate data: Manual work creates room for human error, which is easily avoidable with pitchbook automation. Automatic updates and seamless links between Excel and PowerPoint ensure pitchbooks contain the right data, safeguarding your reputation and securing the prospect’s trust in your firm.

How to Choose The Right Automation Tool

There are many solutions available and searching for the right one can be daunting. To help find your perfect pitchbook automation tool, we’ve broken it down into five simple steps:

Identify Your Needs

Before considering any particular solution, clearly define what your business aims to achieve with pitchbook automation. Speak with those who’ll ultimately use the software, such as your analysts or associates, to understand the hurdles they currently face in their daily workflows.

Evaluate Software Providers

Evaluate different vendors by taking a strategic, long-term approach. Instead of looking for the cheapest option, focus on the potential value gained over the long term (some vendors have an ROI calculator to help you determine this). Make sure the software has finance-dedicated features that can solve your team’s pain points.

Check Integration With Existing Systems

If you’re already working in Microsoft 365, make sure your potential pitchbook automation provider is fully compatible to avoid any disruption to workflows. Ensure the software can integrate, or at least works alongside, other tools your teams may be using too, such as Bloomberg, Pitchly and Bynder.

Focus on Ease of Adoption and Implementation

Search for a provider who specializes in change management and can provide regular training sessions for all your teams. This is essential for achieving high adoption – and avoiding software gathering dust on the shelf.

Ensure the Vendor Offers Regular Check-ins Post-Launch

Choose a vendor who regularly reviews your account post-deployment and is open to feedback from your team. You’ll want to get an understanding of the time saved and the overall impact it has on their productivity. Some vendors, such as UpSlide, provide regular usage statistics, so you can easily quantify the ROI to senior stakeholders.

Want to learn more about vendor vetting? Discover actionable advice for choosing the best investment banking software.

Key Features That Streamline Pitchbook Workflows

For finance professionals producing pitchbooks daily, major parts of the process can be automated to improve overall quality, save time and reduce burnout.

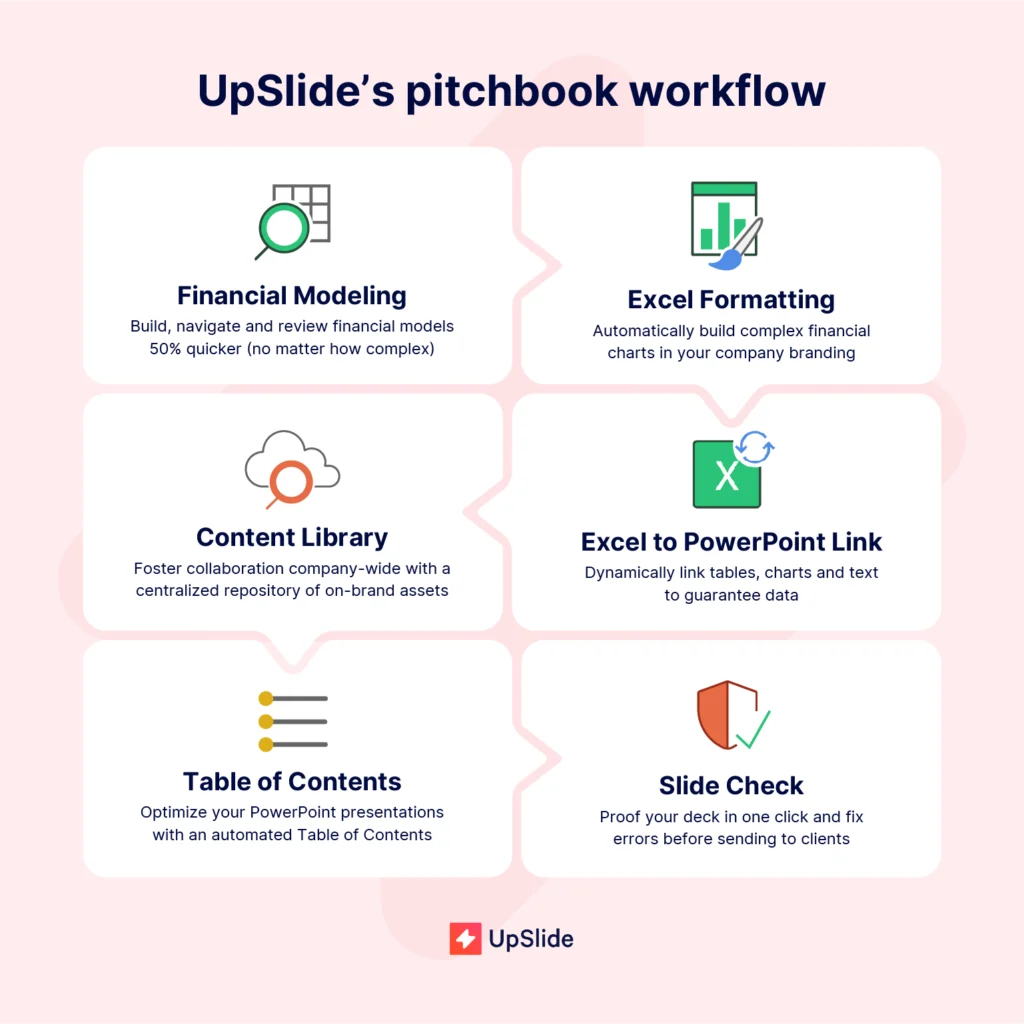

To give you an idea of the types of automation available, we’ll take you through UpSlide’s common pitchbook workflow and key features.

Financial Modeling Features

Financial modeling tools make it quicker to track dependencies, audit cells and build models with accurate valuations.

Just one error can be detrimental – there are plenty of examples of firms losing billions due to small errors in their models. Human error was the cause, but automation makes situations like this easily avoidable.

Excel Formatting

Excel Formatting includes one-click solutions to ensure all your charts, tables and graphs comply with your brand’s image. Instead of spending hours changing each color and font, your teams can send out brand-compliant, professional data points in just a click.

Excel to PowerPoint Link

Bankers and analysts know the pain of linking data with Microsoft 365’s native embedding, only to find the link has completely broken as soon as the workbook is renamed. Leveraging UpSlide’s Excel Link Manager ensures the link remains intact, even if workbooks are moved, versioned or renamed.

Content Library

UpSlide’s Content Library is a centralized database where teams can access approved slides, templates, tombstones and credentials. This speeds up creation, as teams can quickly drag and drop pre-approved content that complies with both brand and legal compliance.

Table of Contents

In just one click, your teams can easily add an automatically-generated Table of Contents (ToC) to pitchbooks, giving your deck a user-friendly structure that makes navigating easier. If the deck structure changes, the ToC will automatically update, ultimately saving teams hours of time.

Slide Check

Slide Check ensures professional pitchbook elements and maintains brand consistency by identifying and fixing errors in just a click, including typos, incorrect fonts, misaligned shapes and empty placeholders.

How Leading Financial Firms Automate Pitchbooks

Forvis Mazars and BNP Paribas

Watch how Danny Malone from Forvis Mazars and Rodian van Druten from BNP Paribas use automation to cut their pitchbook creation time in half.

UniCredit

Before adopting UpSlide’s document workflow software, UniCredit’s teams spent too long creating pitchbooks manually.

Not only was this posing the risk of human error, but lots of time was spent on low-value-added tasks, such as correcting formatting and updating broken links.

Since automating pitchbook creation, the CIB team at UniCredit enjoys more fulfilling, high-value work. Collaboration has improved, teams are feeling energized, and the quality of their pitchbooks is consistently flawless.

Discover UniCredit’s story and learn how to achieve similar successes at your firm.

UpSlide frees up time to concentrate on the real pitching activity. It eliminates the time spent organising the pitch, checking and proofing – you can rest assured that part is done correctly and instead concentrate on idea generation and adding value.

Peter Dieler

Associate Director, DCM

Ready to Improve Your Team’s Efficiency?

Embracing pitchbook automation is no longer just an option for financial firms looking to grow—it’s a necessity.

To transform your team’s efficiency company-wide, discover UpSlide’s pitchbook automation software and book your free demo.

Helpful Automation Resources

- Take a look at our webinar: How To Cut Pitchbook Creation Time In Half

- Watch our investment banking webinar and learn how to: Get ROI From Your Software Strategy

- Discover UpSlide’s Ultimate Guide To Financial Document Automation

TL;DR

Pitchbook automation saves time, reduces human error, and ensures flawless, brand-compliant proposals that win more deals.

UpSlide’s features, like one-click Excel formatting, robust Excel to PowerPoint linking, and a centralized Content Library will transform your team’s efficiency and drive growth for your firm.

To choose the right pitchbook automation tool, identify your team’s needs, evaluate vendors and prioritize long-term ROI over cheap initial costs.