Providing your teams’ with cutting-edge software is necessary to stay ahead of the competition and maximize business performance. Whether it’s generative AI, document automation or advanced data analytics, demand for such technology is high, bringing a critical question to the forefront: how are firms approaching the build vs buy debate?

Read on to learn more about these opposing software procurement paths, the pros and cons of both, and more specifically how the investment banking industry is tackling it this year.

An Introduction to the Build vs Buy Debate

Regardless of the industry you’re in, once you’ve established a gap within your tech stack, you’re faced with two options:

- Build the software internally and be responsible for the customization, maintenance and development of the tool.

- Buy solutions from third-party vendors.

Both options come with opportunities and obstacles, so how do you choose which avenue is right for your business?

Build vs Buy Software: Pros and Cons

Building Software In-House

Pros

There are many benefits to building your own software from scratch; most notably, that you retain complete control over its development – tailoring it to your teams’ needs. Plus, you can rest assured your data remains entirely within your organization.

Cons:

However, ensuring that everyone within the organization is adequately trained on the new tool for high adoption demands extensive internal resources, extending beyond just the IT team. The need for continuous updates, troubleshooting, and support further strains internal capabilities, making the in-house development route increasingly challenging for many firms.

Buying Software Externally

Pros

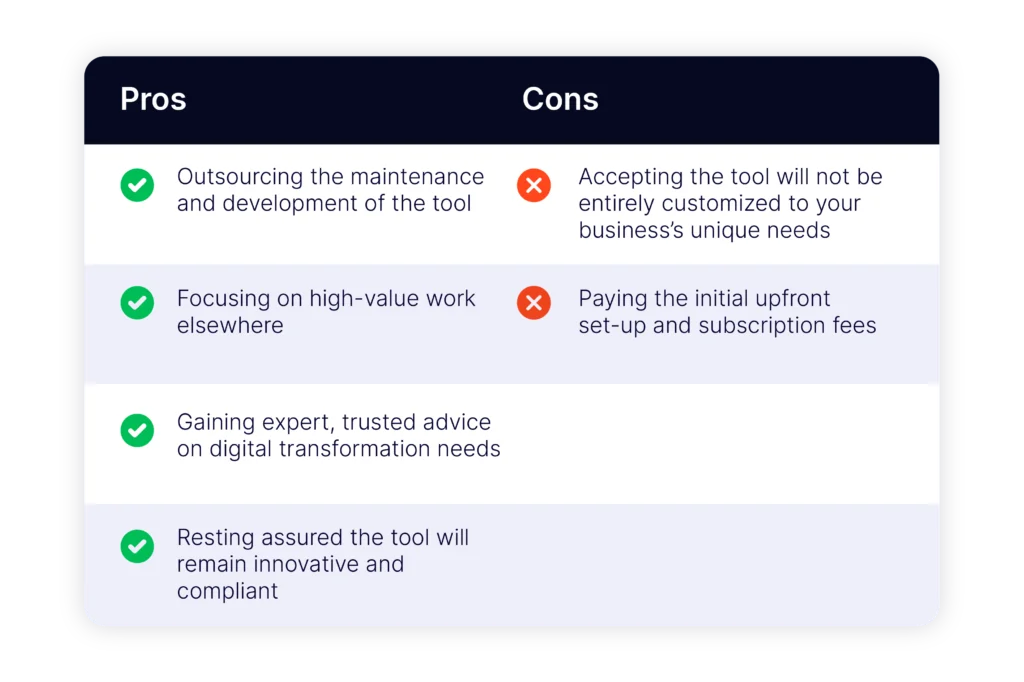

Investing in SaaS solutions comes with numerous benefits that reaps long-term ROI, for example:

- Access to the most innovative technology: SaaS solutions ensure your team is always equipped with cutting-edge technology, increasing the likelihood of adoption into workflows and resulting in positive outcomes.

- Expert, trusted advice: SaaS providers often specialize in specific industries, possessing a greater understanding of your needs and therefore well-positioned to provide valuable advice on digital transformation.

- Optimized internal resource allocation: By outsourcing software deployment, internal teams can focus on high-value work instead of the complexities of software development, maintenance and ever-changing regulations.

Cons

The most glaring obstacle when purchasing third-party SaaS solutions is the initial upfront cost, especially as there are usually set-up and subscription fees. How can you justify the spending to stakeholders when you can’t guarantee ROI from a third-party application?

Build vs Buy in Investment Banking

While historically investment banks favored developing their technology in-house, a global shift is underway, with more financial institutions choosing to invest in external SaaS solutions.

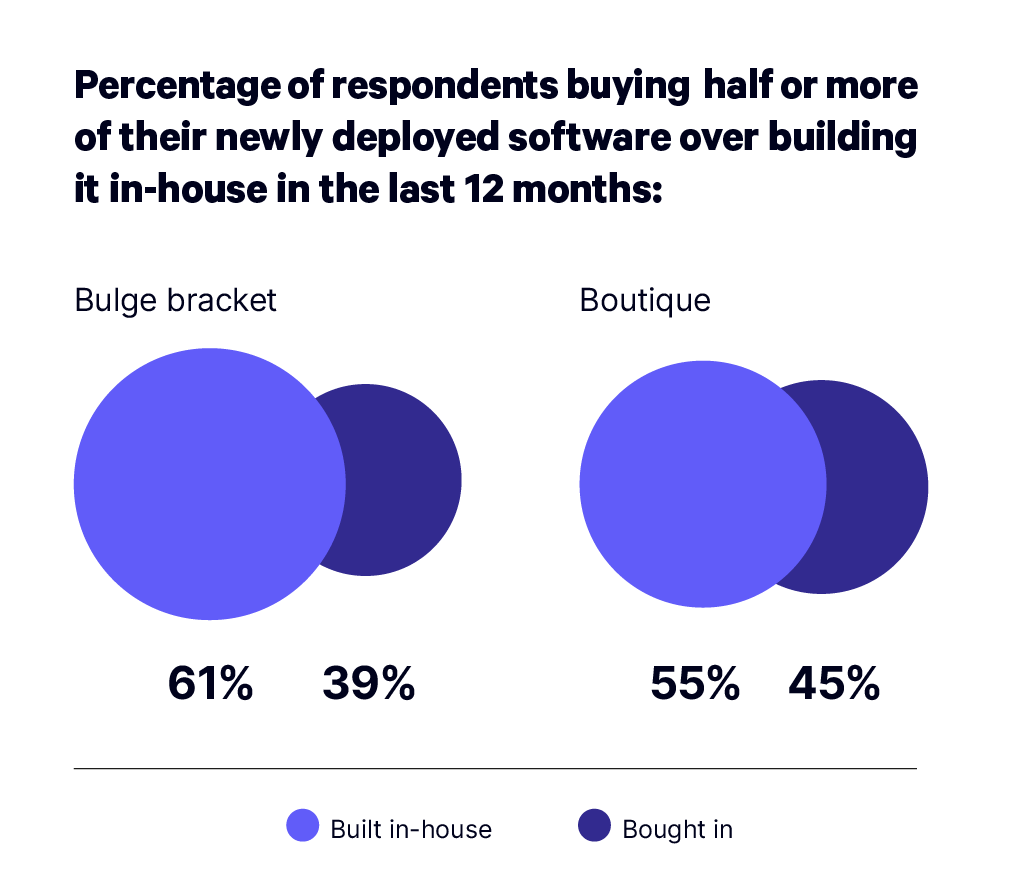

We spoke with 600+ IT and innovation leaders across the globe to understand software spending habits this year, and found that nearly 60% of them are procuring half or more of their tech stack externally.

So, what’s driving this pivot away from in-house development, specifically in investment banking? And which SaaS solutions are capturing the attention of investment banks?

Why Investment Banks are Buying Software Externally

The challenges and demands of the industry have evolved; increased regulatory requirements and new technological innovations makes in-house software development challenging. Building and maintaining internal tools requires substantial time and financial investment to ensure they remain industry-standard and compatible with third-party providers, such as Microsoft 365 or Bloomberg.

Our research shows that compliance and regulatory requirements is the primary reason for choosing SaaS over in-house development. In today’s highly regulated landscape, ensuring adherence to industry standards is paramount and can be costly. SaaS providers, with their specialized expertise, can offer robust compliance solutions and provide peace of mind.

Scalability and flexibility are also critical considerations, particularly for leaders in the US and UK. These features are challenging to achieve in-house without significant strain on internal resources. SaaS solutions, by design, offer scalable and flexible options that can adapt to the evolving needs of investment banks.

As noted by Forbes: “Even if a bank is equipped with the right technological expertise to innovate and implement new customer solutions, it can still struggle to get to market quickly — or at least in time to compete before the next trend hits.”

UpSlide is lightyears ahead of our previous add-in, with features to increase uniformity and productivity across teams.

Vice President

Greenhill

How Geography and Company Size Influence Banks’ Decision to Build or Buy Software

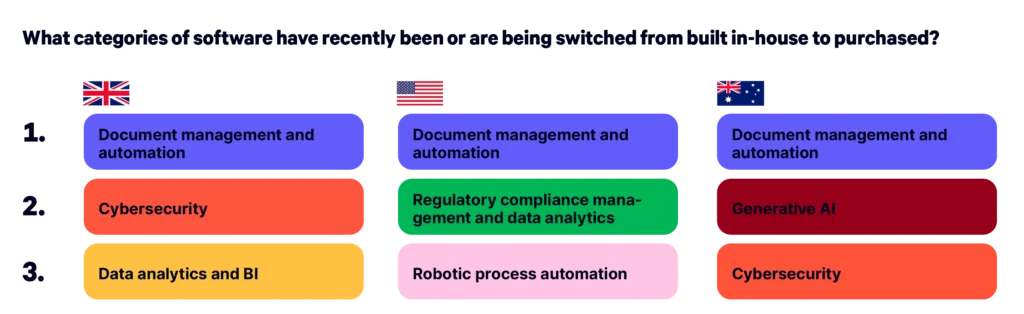

Diving into the ‘Investment Banking Software Report’, geography influences how investment banks approach the build vs buy debate. Australia is leading the shift in software procurement, followed by the US, with the UK trailing behind in SaaS adoption.

When examining differences based on company size, bulge bracket firms are the most frequent purchasers, with 61% procuring half or more their tech stack externally, compared to 55% of boutique firms.

What Types of Software are Investment Banks Building, and Buying?

Document Management and Automation

When examining the types of software investment banks are purchasing, a few clear trends emerge. Document management and automation software top the list, with 41% of respondents indicating they’ve recently switched from build to buy. This shift highlights the growing efficiency and effectiveness of external solutions in streamlining document-related processes and enhancing productivity.

Generative AI

It’s unsurprising that generative AI (gen AI) isn’t consistently included in the top three software categories to buy over build. Many investment banks and financial services firms, such as Deloitte and JP Morgan, have chosen to develop these solutions in-house. The preference for in-house development in this category is likely due to the unique nature of generative AI, as LLMs need to be trained on specific datasets to produce tailored and unique outputs. This need for customization and data specificity makes in-house development more appealing for investment banks.

What to Consider When Choosing a Software Vendor

Regardless of which SaaS solution you invest in, whether it’s document management and automation, generative AI, or cybersecurity, the most critical decision in the purchasing process is selecting the right vendor. Ensuring you choose a vendor that aligns with your needs and objectives is paramount for a successful implementation.

Start by undertaking a robust software selection process, evaluating vendors against a set of criteria to ensure the best fit for your organization. Key questions to ask include:

- Integration: Does the vendor’s solution integrate seamlessly with your existing tech stack?

- Support: Do they offer effective change management, implementation, and adoption support?

- ROI metrics: Will they provide clear ROI metrics that you can share back to the wider business and/or relevant stakeholders?

Conducting thorough due diligence early on will lay the foundation for a successful partnership. It ensures that your investment delivers better long-term results and enables you to remain innovative in an ever-evolving industry.

How Greenhill Changed From Build to Buy and Saw ROI

Before UpSlide, Greenhill’s analysts were struggling with inefficient document creation workflows, spending hours searching for compliant content.

They built an internally developed add-in, however, it became difficult to maintain, so they chose to seek an external solution.

They recognized UpSlide as “lightyears ahead” of their previous add-in, with features to increase uniformity and productivity across teams.

Now, with UpSlide, their bankers are saving over six hours per month building presentations. This time gained can be put towards more strategic, value-added tasks.

Key Takeaways: The Build vs Buy Debate

If you’ve been weighing up whether to build vs buy software, hopefully, this article has shed some light on how the investment banking industry is approaching it this year.

Overall, we’re witnessing a shift towards buying software like document automation and cyber security; it’s likely due to the sheer internal resources it would take to abide by compliance and regulation requirements, and remain compatible with the latest technological innovations.

However, there are certain categories of software, such as generative AI, where developing in-house might make more sense, due to the nature of how it’s developed, and the need for it to be hyper-tailored to deliver useful output.

Find out how we ensure our clients see ROI, with our best-in-class support and diligent, in-house implementation specialists.

If you want to find out more about SaaS investment trends this year, download the investment banking software 2024 report in full.

TL;DR

A recent survey, conducted by UpSlide, of over 600 IT and innovation leaders within investment banks reveals that they’re increasingly investing in external SaaS solutions, such as document automation and advanced data analytics, to stay competitive and enhance business performance, shifting away from the traditional in-house development approach.

The decision to invest in SaaS is influenced by the need for cutting-edge technology, expert advice, and optimized resource allocation, ultimately leading to higher ROI and better long-term results.

Despite this shift, many banks are still building generative AI solutions in-house, likely due to the nature of this software and how tailored the output needs to be to see true value.