Today’s bankers are trying harder than ever to preserve their mental and physical well-being – a desire which extends to all ranks in the industry, even the C-level. According to our research, 72% of investment bankers are considering leaving the industry to avoid workplace burnout. Those who don’t feel supported are not afraid to quit the company or the industry altogether. For those looking to jump ship, technology, cryptocurrency, fintech and private equity are top of the list.

Not wanting to risk losing their top talent, banks have adapted, proposing various strategies to prevent workplace burnout… but are these enough to have an impact on their employees?

We wanted to speak directly with those on the front line – the bankers themselves – to find out what they really want, and what will keep them happy in the industry. In partnership with Censuswide we surveyed 200+ financial services professionals, at all levels of seniority, across the UK, France and the US. For the complete statistics, discover the full report here.

TL;DR

72% of investment bankers are considering leaving the industry to avoid workplace burnout.

We spoke directly with those on the front line – the bankers – to find out what they really want, and what will keep them happy in the industry.

Is it a good work-life balance, a more fulfilling workload, or integrated productivity tools?

A Good Work-Life Balance

76% of bankers said they would consider a lower salary for a better work-life balance

Hard graft for high salaries has always been the central tenet of the investment banking industry. While in the past, this approach was accepted by employees, it is becoming unsustainable for today’s bankers, who are feeling less and less comfortable with their work-life balance.

It’s not just about long hours in the office, however. Almost a third of the investment banking employees surveyed for our report fail to use all allocated annual paid time off (PTO) due to fear of unbearable workloads to manage on return.

There is evidently a desire to change, as banks are now implementing measures to support their employees’ work-life balance. For example, J.P. Morgan’s pencils down policy of 2016 has been given a facelift. The bank now encourages employees to go home by 7pm on weekdays and forces them to take at least 3 weeks’ vacation per year.

47% of our respondents said that their employers currently have measures to prevent working over the weekend, while 34% said they have measures to prevent working extra hours during the week. Though a positive sign, these figures suggest there is still more to be done to support today’s bankers.

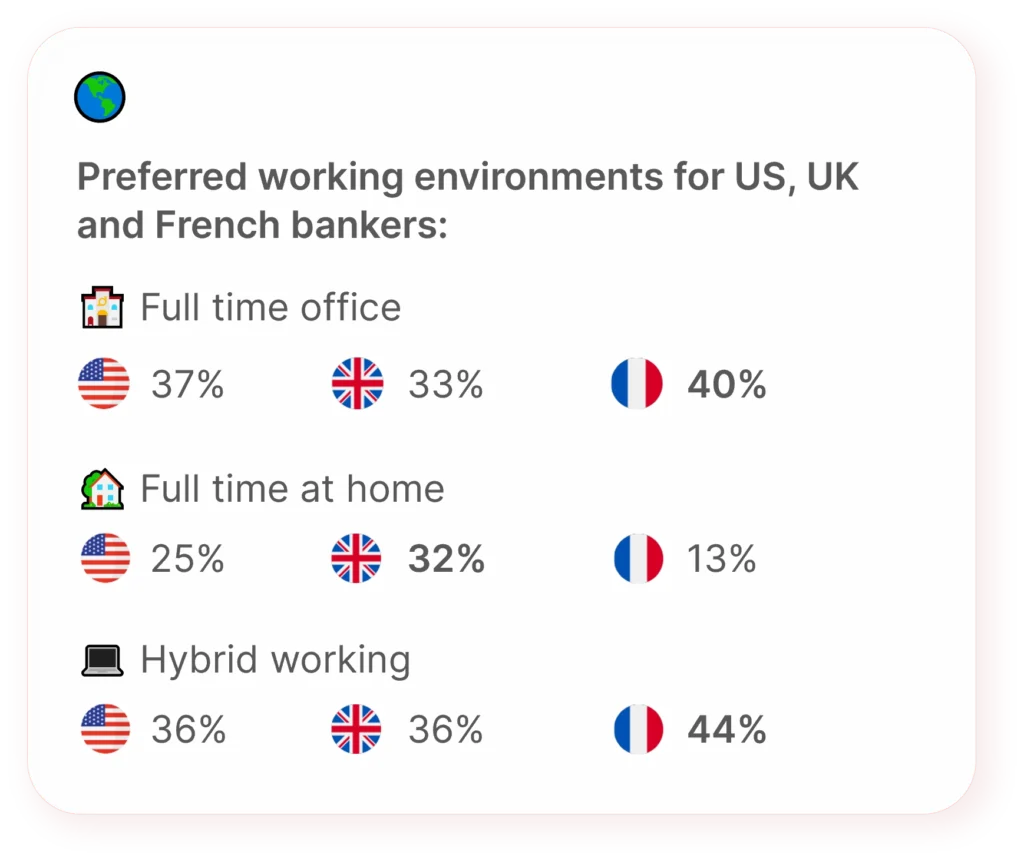

Perhaps the answer is to embrace more hybrid working solutions. While opinions do differ on the positive impact of hybrid working practices, when asked in which work environment they would feel most comfortable, 72% of Analysts favored a hybrid working model compared to 28% of Senior Associates and just 16% of Vice Presidents. This could reflect the changing desires of younger employees for whom office working is unfamiliar and less desirable.

Internationally, opinions seem fairly split, with no clear favorite across all levels of seniority. Though there is evidently no one-size-fits-all rule, to offer the best support, banks need to lead the conversation and understand what works best for their employees.

One bank trying to foster a healthy work-life balance for their juniors is BNP Paribas SA. In April 2022, the bank signed a remote working charter with union representatives in Europe allowing 132,000 employees across 22 countries to work remotely for 50% of the working week.

While we can’t expect investment banks to change overnight, advances like this are a key step in restoring the work-life balance of today’s bankers.

A More Fulfilling Workload

80% of bankers feel that manual tasks are a ‘rite of passage’ in the industry

Spending hours drafting pitchbooks and information memorandums in Microsoft Office is a familiar experience for every junior banker. Managing between 30-40 revisions of these documents, within hours of a deadline is, of course, highly frustrating.

Our research shows that investment bankers can spend anywhere between 10 to 40 hours per week in Microsoft applications on manual tasks such as presentation formatting and updating data points. Frustration over these tasks has left 50% of Senior Analysts considering a move due to feeling unfulfilled in their daily roles.

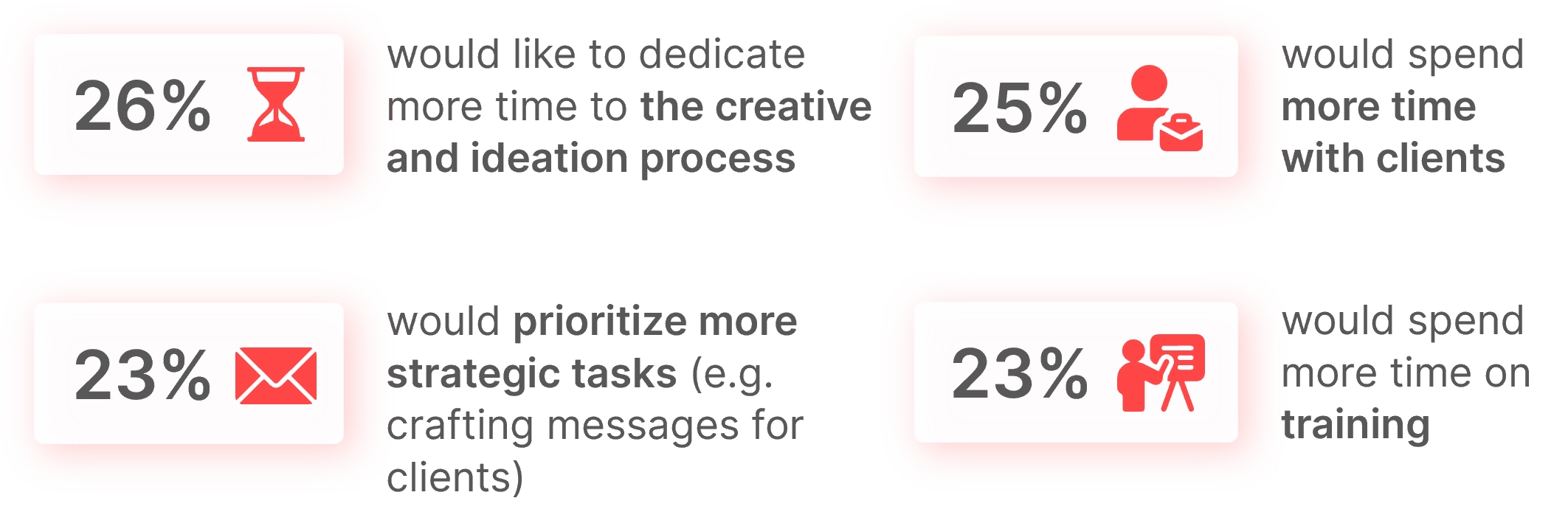

Instead of spending hours on low value-added tasks, investment bankers want to dedicate their time to more fulfilling responsibilities, such as communicating with clients or analyzing market reports. If given more time:

Greater focus on these value-added tasks could increase day-to-day job satisfaction for bankers, whilst directly contributing to business output and success.

Discover the 7 ways investment banks are improving junior banker retention

Integrated Productivity Tools

Nearly 90% of investment bankers feel they would benefit from a tool to automate tasks in Microsoft Office

The first step all banks can take to minimize unfulfilling tasks is implementing automation technology. Dan Dees, Co-head of Investment Banking at Goldman Sachs, agrees, commenting on the bank’s investment in technology: “The goal with this is to allow younger bankers to do more and more of the meaningful, and less and less of the menial.”

In a similar vein, UniCredit implemented UpSlide to boost productivity and efficiency around daily operations – specifically around pitching – to free their bankers to work on more rewarding tasks. By automating tombstone creation and document formatting, UniCredit bankers now have extra time to work on data analysis and strategy.

UpSlide should result in shorter working hours, or at least more productive ones.

Our teams are happier when they’re being productive, doing high-value work and learning, instead of formatting and copy-pasting.

Muge Mentes

Head of CEEMEA Debt Origination

Mazars also invested in automation technology to provide current and future associates with the tools to work smarter and more efficiently in Microsoft Office. This helps them attract and retain top talent by demonstrating their commitment to innovation and employee satisfaction.

Ultimately, providing employees with innovative tools like UpSlide will enable banks to compete better in the battle for great talent. Any bank to adopt this approach will set themselves firmly ahead of their industry peers for the future.

Discover how UpSlide helps investment banking teams boost productivity

More Support for Employee Wellbeing

86% of bankers have felt forced to take time off due to stress

Mental health support still ranks highest in priority amongst today’s bankers. In light of this, our research found that 43% of banks now have measures to foster and champion employee wellbeing. After launching an initiative that offers free online therapy courses to employees, NatWest saw 5,500 staff sign up in its first six months. Likewise, Lloyds is offering their employees free access to the meditation app, Headspace.

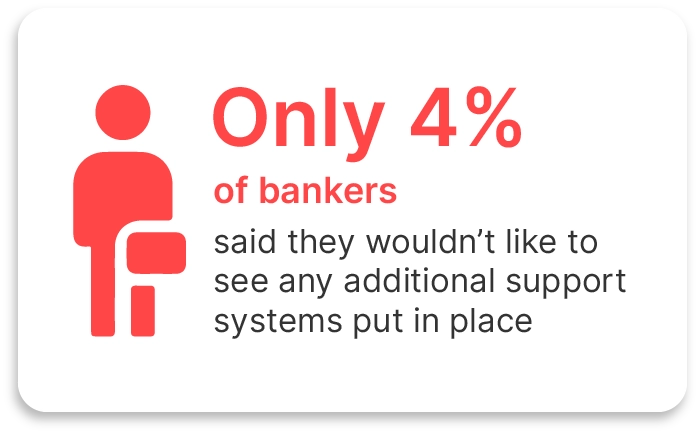

Even so, 32% of investment bankers would like greater support for mental health, including regular check-ins and offers of medical consultations.

Offering this kind of support has its benefits at the corporate level as well as the personal. For Bank of America, maintaining in-office wellness programs and health-related assessments, like the Health Risk Assessment, has resulted in a 10% decrease in healthcare costs for the firm over a two-year period.

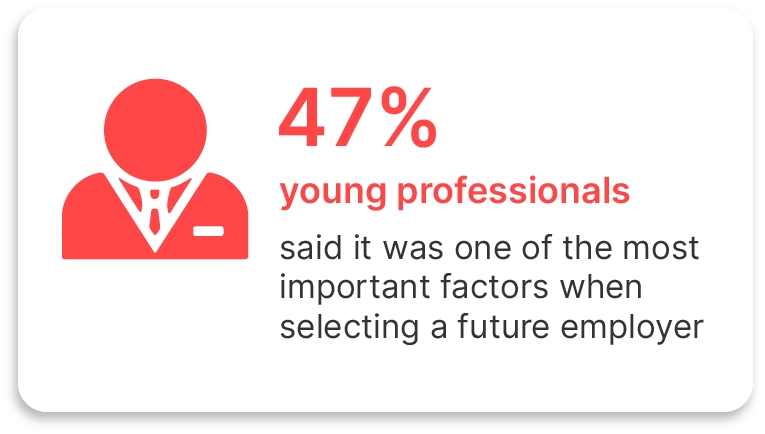

Moreover, a recent Deloitte report found that 47% of young professionals view mental health support as one of the most important factors when selecting a future employer.

For banks, offering this kind of support is essential for retaining key talent and enhancing overall productivity. At the end of the day, this can only benefit the banks themselves and boost their bottom line.

Our Conclusions

Positive change is certainly taking place and many companies are actively trying to reduce burnout. There’s a range of different approaches – whether it’s flexible working, productivity software or additional mental health support – but, bankers are still looking for more. It’s not necessarily the hours, or the pay-outs, but rather the type of work they’re doing that matters most to today’s investment bankers.

More than ever, bankers want to spend their time on higher-value work such as more client-facing time, market analysis and training. Ultimately, this can only prove more profitable for the bank and more fulfilling for employees.

Was this article interesting? For more exclusive insights on the investment banking industry, download the full banker burnout report below, or discover what the top 100 Fortune companies are doing to keep their employees happy.