Operational inefficiencies have been an ongoing challenge for the investment banking sector for years.

A 2019 study by UpSlide, in partnership with the CSA, revealed that 86% of bankers felt low-value tasks in Microsoft 365 detracted from their core business functions. Alarmingly, this trend persists. Recent findings from an UpSlide and Williams Lea report show that both bankers and operational leaders agree — administrative overload among junior bankers remains a significant challenge holding firms back.

But what is specifically causing this administrative inefficiency, and how can banks remedy this to secure their employees’ long-term productivity?

Read on to discover insights from over 300 investment bankers and operational leaders across the US, UK, Australia, Hong Kong, Singapore, and Japan.

The Productivity Problem: How are Banks Affected?

36% of junior bankers report that admin work consumes a significant amount of their time.

Source: Driving Efficiency and Outcomes in Investment Banking, p4

Manual, repetitive tasks are almost synonymous with the junior banker workload — a fact that both bankers and operational leaders can agree on.

The three areas that consume the most time in junior bankers’ day-to-day are data entry and management (voted by 42% of bankers), financial modeling (43%), and scheduling and administrative support (32%).

Repetitive, manual tasks, like refreshing data points in a pitchbook, not only detract from higher-value activities like client analysis and deal strategy but also open the door to human error — a costly risk in the high-stakes world of financial services.

While manual tasks might be a necessary evil for junior bankers — how they handle these tasks, and their general productivity levels can have a huge impact on their bank’s bottom line.

How are Banks Tackling Operational Inefficiency?

With the potential threats that administrative tasks can pose to the bottom line of a business, investment banks must align — from junior bankers to operational leaders — on how to handle these tasks efficiently.

Two solutions stand out the clearest for investment banking teams: outsourcing to strategic partners, and implementing investment banking software solutions.

Software Poses a Solution to Bankers’ Productivity Woes

85% of bankers and operational leaders view software as the key to improving junior banker efficiency.

Source: Driving Efficiency and Outcomes in Investment Banking, p5

In a 2022 UpSlide survey, we found that nearly 90% of investment banking employees felt they would benefit from a tool to automate tasks in Microsoft 365. Recent years haven’t curbed their enthusiasm either, as 85% of bankers and operational leaders agree that software is the top solution for improving banker efficiency.

When deployed correctly, technology has the potential to transform the output of bankers at all levels, with the time saved from automation being reinvested into strategic tasks that protect the bottom line.

Bracing Banks for the Highs and Lows of the Market

Investment banks are on constant alert for fluctuations in market demand, as it directly affects their core strategies when it comes to team headcount, capacity, and support.

With the M&A market steadily on the rise from the lows of 2022, team capacity is set to become slimmer and slimmer, especially with the cuts in headcount that many banks have taken on in 2024. In this light, it becomes clear why 47% of bankers and 52% of operational leaders cite investing in technology solutions as the best approach to navigating the peaks and troughs of market demand, enabling their firms to enhance resource allocation.

Improving Client Service and Deliverables

With competition within the sector steadily on the rise, investment bankers are in a constant fight to retain their top clients.

Bankers and operational associates agree on the potential for software to improve client deliverables and service:

- 61% of COOs suggest that software will help give clients a faster, more responsive service.

- 73% of operational associates, with more visibility on the ground floor, maintain that onboarding new software will improve team collaboration, thus providing a smoother service to their clients.

- 55% of associates believe that technology leads to increased client satisfaction.

Aiding Retention and Limiting Burnout

Investment banking burnout was top of mind during the pandemic, and while there seemed to be a slight lull in awareness for a few years, it’s back on everyone’s radar. Throughout 2024, we’ve seen yet another wave of banks capping working hours for juniors at 80 hours.

Demonstrated in the “Driving efficiency and outcomes in investment banking” report, both the front-office and operations team share common ground on the benefits of technology for improving banker retention. 91% of bankers and 93% of operational leaders unanimously agree that current technologies and process are already improving the work-life balance of junior bankers, ultimately contributing to greater quality of output and longer retention.

And despite the “rite of passage” culture so common within the sector, even 65% of Managing Directors uphold that investment banking software positively impacts banker retention rates.

Fundamentally, if banks reap the benefits of implementing software — with improved long-term market resilience, reinforced client loyalty, and burnout-free productivity — they’ll ultimately safeguard their bottom line for years to come.

Make Your Next Software Investment a Success

So what solutions are investment banks specifically looking for to boost their bottom line?

AI and automation, communication and collaboration, and project management solutions were voted the top investments for both bankers and operational leaders.

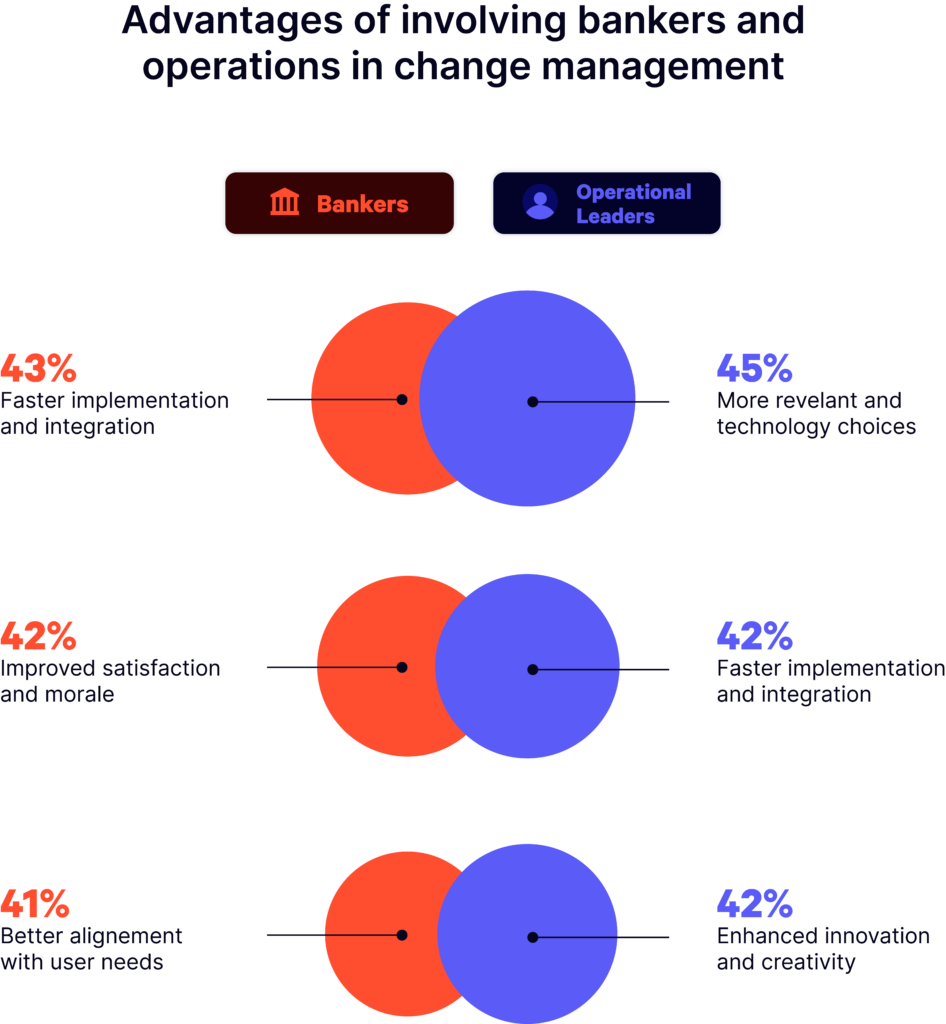

43% of bankers, and 42% of operational leaders believe that stakeholder involvement leads to faster tech implementation and seamless integration.

Source: Driving Efficiency and Outcomes in Investment Banking, p14

Bridging the gap between banking, operational, and tech leaders is the first step that every business should take before pursuing a new software investment.

Both bankers and operational leaders agree on the advantages of involving stakeholders in the change management process for new tech, and for aligning with the current workforce. 60% of Managing Directors believe this results in faster implementation and integration, while 55% of Associates believe that this alignment cultivates more innovation within the firm at scale.

Christina Maddy, Executive Director at Nomura, mentioned the importance of aligning bankers and leaders in a recent UpSlide webinar. She states that success as a tech leader comes from “understand[ing] the granularities in the day in the life of a banker and the lifecycle of a transaction. That way, [you] can identify the biggest pain points and areas for improvements, which then forms [your] book of work.”

Change management doesn’t have to be entirely internal either. The gold standard investment banking software providers will offer tailored adoption plans to onboard teams at scale, while also supporting long-term partnership to ensure the software stays tailored to your teams’ evolving needs.

Outsourcing Equips Banks for a Competitive Market

42% of bankers and 48% of operational leaders cite outsourcing as an effective solution to navigate fluctuations in market demand.

Source: Driving Efficiency and Outcomes in Investment Banking, p17

Outsourcing has always been a popular solution within investment banks, due to the benefits of alleviating team capacity across the business and the reduced demand for training within the ranks.

In fact, bankers tend to prefer the solution over internal cross-training, with only 38% of bankers viewing the cross-training approach as important, preferring to be more specialized and better equipped to tackle their individual workloads.

Both bankers and operational leaders see the benefits of outsourcing to the business, believing it will bring improved deal outcomes, greater cost efficiency, better team collaboration, and increased client satisfaction.

When it comes to supporting the long-term success of a firm, both functions are equally aligned, with 42% of bankers and 48% of operational leaders citing outsourcing as an effective solution to navigate fluctuations in market demand — revealing a cross-function alignment when it comes to maintaining the bottom line.

The Future of Productivity in Investment Banking

While tasks like financial modelling and pitchbook creation will likely always remain a part of junior bankers’ lives, the time it takes them to do these tasks can be reduced with the right tools and support. The firms that handle these tasks most efficiently for their workforce will be the ones to retain a competitive advantage.

If there’s one thing bankers and operational leaders clearly agree on, it’s that software is the most effective solution to many of the routine troubles that banks face. From mitigating administrative overload with changing headcounts, to improving employee retention, and navigating the ups and downs of the market, both bankers and operational leaders can both agree that technology will help them bolster the bottom line long-term.

Banks need to pursue strategic investments in technology, alongside strategic partnerships, to satisfy employees across multiple seniorities and deliver tangible returns to the business.

Want to find out the benefits that investment banking software can bring to your business? Contact an UpSlide expert.

Resources to Help Your Team Optimize Efficiency

- For the source behind this data – read the full report with Williams Lea

- Discover more about how investment banks are approaching their technology decisions

- Find out more about how investment banks are navigating employee retention challenges

- Learn how to guarantee ROI on your next software purchase