Investment banks are currently experiencing the busiest time the industry has ever seen, bringing in over 33 billion in fees in Q1 last year.

This ever-growing workload, along with the increasingly blurred lines between home and work throughout the pandemic, has reportedly contributed to 85% of analysts leaving investment banks within their first two years.

Plus, with millennials prioritizing a healthy work/life balance more than ever before – it’s not surprising that entering a career or transitioning into the comparably paid, more relaxed environment of private equity or technology is tempting for junior bankers.

So, what can banks do to attract and retain top young talent?

Discover some of the initiatives that Barclays, Citigroup, Goldman Sachs, Moelis & Co and more are implementing to try and achieve just that.

TL;DR

85% of analysts are reportedly leaving investment banks within their first two years.

Many of the top investment banks are responding by introducing initiatives to attract and retain top young talent.

Will improving work-life balance, introducing employee mental health support initiatives, or investing in technology be key to achieving this?

Re-Evaluating the Traditional Banking Culture

Throughout the pandemic, many bankers have begun to realize that 100-hour working weeks are unsustainable and have quit the industry altogether or begun pushing for change.

Many leading banks have made steps towards re-engineering their DNA and shedding this historically gruelling culture to create a more sustainable work environment. Here are some of the new initiatives that have been introduced:

1. How Barclays are Improving Work/Life Balance

Barclays has launched a ‘pencils down’ policy to prevent junior bankers from working between 9pm on a Friday to 9am on a Sunday. Under this initiative, senior bankers will not contact junior bankers on the weekend unless working on a live, urgent deal. Plus, seniors should no longer assign any work with a Monday deadline after 12pm on Friday.

Barclays also encourages their youngest employees to take two, five-day vacations a year to equilibrate their work/life balance.

John Miller, global head of banking coverage, said that Barclays are “keenly aware” of the challenges faced by junior bankers and want to act responsibly to ensure that they’re investing appropriately in the mental health of their team.

2. How Moelis & Co and Citigroup are Reworking Pitchbook Policies

Moelis & Co has tried to reduce the workload around pitchbook creation to improve the day-to-day lives of junior bankers and increase their job satisfaction. They’ve amended their pitchbook policies to:

- Limit the size of pitchbooks for non-live deals.

- Encourage seniors to sign-off pitchbook shells before analysts produce content to avoid wasting time.

- Enforce that pitchbooks cannot be changed 12 hours before the deadline.

Citigroup has also introduced a similar solution and have placed a 15-page limit on pitchbooks.

3. How Citigroup are Optimizing Hybrid Working

In July, a Financial News survey of senior financial services professionals found that 50% would consider quitting if their employers didn’t offer flexible working arrangements. Only 10% wanted to return to the office full-time.

James Bardrick, who runs Citigroup’s UK division, recognizes that “the pandemic has been an accelerator for more flexible working and made [them] more confident that the business can operate effectively if people spend some of their time at home.”

However, blurring the lines between home and work is also a catalyst for burnout. So Citigroup are also introducing new ways to prevent bankers from getting Zoom fatigue and feeling isolated when working from home.

CEO Jane Fraser says they’ve implemented “Zoom free Fridays” to encourage time away from the screen. Plus, head of consumer products group Elinor Hoover has launched virtual events like trivia quizzes to connect with the department’s 60 junior bankers.

No one expects banking culture to change overnight, but these small initiatives and new policies could be a catalyst for further positive movement in the industry.

Prioritizing Employee Mental Health

Two out of three people working in financial services have experienced mental health issues as a result of work or where work was a related factor, Reuters states.

Several analysts have commented on how the investment banking industry places “tremendous strain” on the mental health of juniors as “normalized” long hours also mean a lack of social life, family contact, dating or exercise.

Nevertheless, these conversations have sparked positive change in the industry as many leading investment banks have taken concrete steps to improve mental health in the workplace.

4. How JPMorgan Chase & Co and Goldman Sachs are Providing In-House Mental Health Services

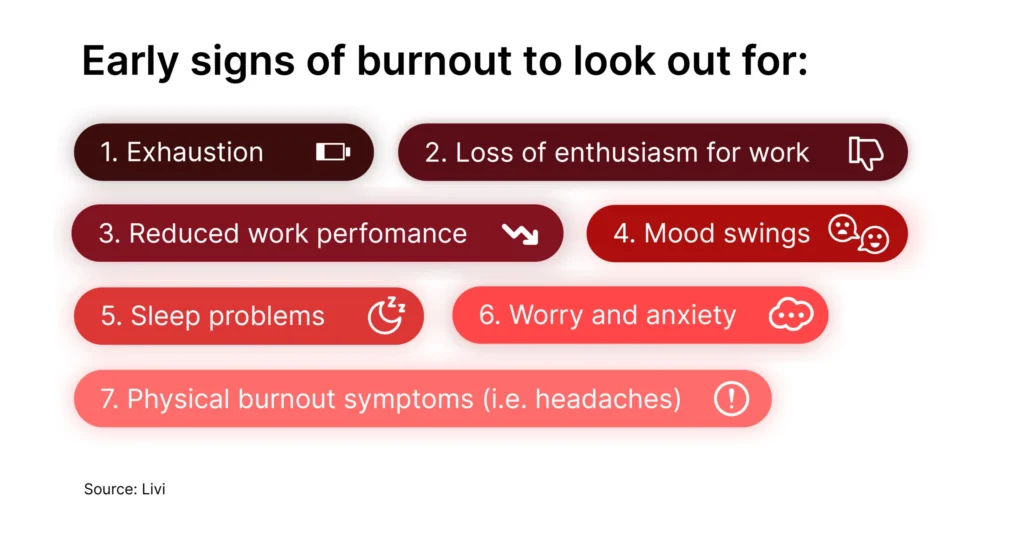

Outgoing analysts have reported that pandemic working conditions have made burnout even more prevalent in junior bankers. Many first-year bankers have never seen their colleagues or bosses other than on screen, creating a culture of isolation.

Remote working also makes it more challenging for seniors to spot these early burnout signs in young employees and take action.

JPMorgan Chase & Co are supporting their staff with on-site mental health counsellors across the globe – including New York, Delaware, Chicago, and London. They’ve developed an in-house Employee Assistance Program, which offers their employees free, confidential, short-term counselling and referral services.

Goldman Sachs executive director Beth Robotham says that they’re also responding to this crisis by training in-house mental health first aiders. This will enable internal experts to look out for body language cues in their staff, to flag signs of burnout and support them better.

5. How Houlihan Lokey are Rewarding Staff with R&R

One of the main reasons junior bankers say they leave their role after two years is that they feel overworked and underappreciated.

Boutique investment bank Houlihan Lokey has recognized the need for firm-wide wellness initiatives and recently introduced a new perk that encourages staff to disconnect from work and recharge their batteries. They’re rewarding all their financial staff with an all-expenses-paid holiday, with ten full days out of the office.

The perk was announced by the company internally – detailing that:

- Anyone from the U.S corporate finance division (at a range of preselected destinations across North America, Europe and Asia) can redeem this trip.

- If the employee does not want to take a holiday, they can transfer the trip to any family or friend or exchange it for a charitable donation.

- It is not in lieu of their regular bonus or a deduct.

Investing in Technology

Banks are increasingly turning to technology to free up capacity for junior bankers and increase job satisfaction.

Companies including Goldman Sachs, Barclays and Moelis & Co have initiatives to automate everyday tasks for analysts, such as generating pitchbooks and financial modelling.

6. How BNP Paribas are Automating the Heavily Manual Tasks

BNP Paribas save their bankers time by automating the heavily manual tasks in their day-to-day lives, such as PowerPoint formatting and updating Excel workbooks.

Julien Polenne, Head of IB Transformation, recognises that: “Our resources are valuable but scarce. We need to preserve them to avoid wasting time on low value-added tasks. With UpSlide, our teams can focus on core business.”

Today, we spend too much time on low-value added tasks. Tomorrow’s bankers need supercharged tools like UpSlide to increase productivity. The key to success is knowing the right tools.

Julien Polenne

Head of IB Transformation

Junior bankers at BNP Paribas use UpSlide, a branding and productivity solution designed for finance professionals, to streamline their pitchbook creation process and provide more time to create higher-quality deliverables.

Huw Richard, global head of digital investment banking at JPMorgan Chase & Co also invests in technology to relieve staff of heavily-manual tasks: “This is not about people working less. This is about people working on things they value.” This newfound focus on employee wellbeing and value will retain existing staff and help attract fresh new talent, perhaps even from a more diverse pool.

7. How Goldman Sachs are Employing Innovative Technologies

Goldman Sachs invests in technology to improve daily communication between junior and senior bankers.

COO, Luke Sarsfield described a new internally-developed ‘ASK GS’ service, which quickly answers any general questions that junior bankers may have. He claimed that it reduced the number of email blasts from analysts by 98% – saving their juniors and seniors time.

They’ve also repurposed the role of their Strats team (previously known as financial engineers or data scientists) to create a unified engineering front that works with bankers and clients directly, with two key goals in mind:

- to digitize bankers’ workflows through tools that improve productivity and quality of life

- to use technology that is to engage clients in a more modern, data-driven way.

Conclusion

In today’s technology-driven climate, junior employees want to see that their company is investing in them. Businesses that effectively employ innovative technologies to simplify their daily lives will have an edge when attracting new talent.

This challenge seems to be forcing positive change across the industry. If investment banks continue to create more rewarding and attractive work environments, they’ll not only retain their existing employees but also attract new talent from a potentially more diverse pool.

What’s more, in addition to improving staff retention, banks will also benefit from overall increased productivity levels thanks to a more efficient and motivated workforce – as happier workers are 13% more productive. As Mel Newton, Head of Financial Services workforce consulting at KPMG observes: “What actually drives productivity in th[e] workplace: is it long hours, or happy employees? You are going to get much more out of a group of people who love working, love the organization, and feel valued.”

Be sure to bookmark our content hub and follow us on LinkedIn to stay in the loop with our industry-specific updates!