Struggling to execute branding strategies with so much red tape? This guide helps you overcome the unique branding challenges that loom over financial services, from strict global regulations to building client trust.

Read on to find out how building a stellar financial brand reduces the need for in-house resources, ensures regulatory compliance and breeds client loyalty.

Drive Business Success With Solid Financial Branding

Financial branding is about creating a strong, recognizable identity that resonates across different client verticals.

Strong branding drives business success by increasing marketing ROI, helping your firm win more deals and increasing User Lifetime Value (ULV), which we’ll cover later in the blog.

At UpSlide, we’ve got 14+ years of experience building strong financial brands in the following sectors:

- Investment banking

- Financial advisory

- Private equity

- Asset management

This experience has given us an in-depth understanding of the different needs per industry. For example, asset management firms will need to convey stability and reliability in their branding to show they can be trusted to manage large amounts of money for a long time.

Branding for private equity, however, needs to demonstrate your firm’s ability to innovate, provide cutting-edge insights, and make your limited partners as much money as possible.

Branding Goes Beyond the Visuals

Regardless of whether you’re an investment bank or an advisory firm, a strong financial brand incorporates more than just the visuals.

Here’s a useful definition we like to use at UpSlide.

“A brand is more than logos and slogans, it’s a range of expected outcomes you can expect from any company or person… what you can count on, rely on, and plan around.”

Permanent Equity

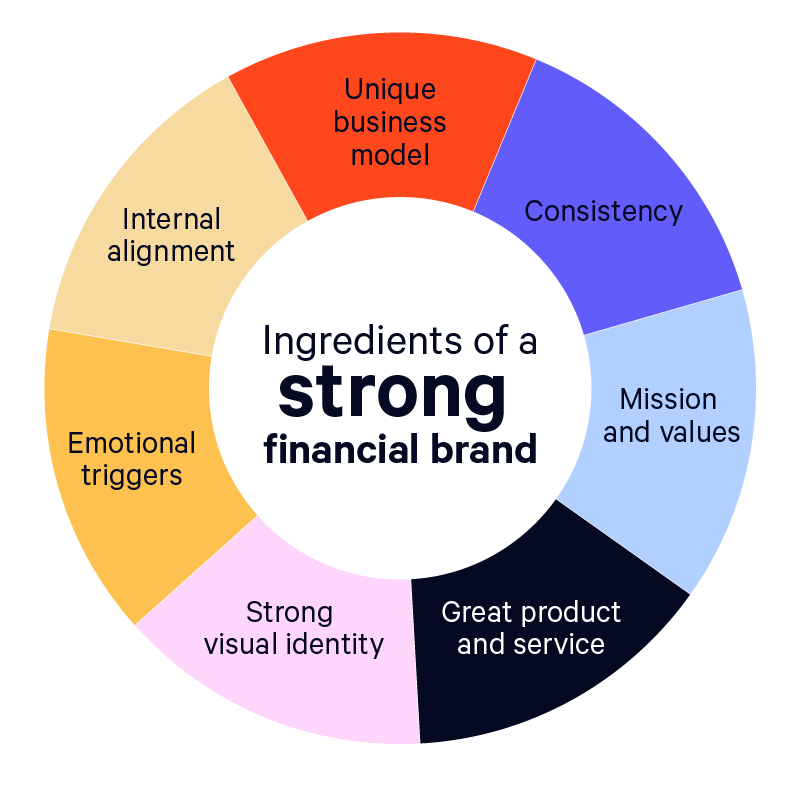

Many financial services brands are successful because their branding strategy is a combination of seven key ingredients:

- A unique business model that differentiates your brand in a crowded marketplace

- Missions and values (also known as the “why”) that resonates with clients on a deeper level to build emotional connection

- Consistency that gives consumers the same experience of your brand’s image at every touchpoint

- Great product and service to ensure client satisfaction and positive word-of-mouth to reinforce your brand’s credibility

- Strong visual identity that’s smart, sleek, professional and memorable

- Internal alignment to turn your employees into brand ambassadors

- Emotional triggers to strengthen relationships and foster loyalty

All of these key ingredients instil trust in your brand and make it easier to create, capture and convert demand.

How to Strengthen Your Financial Brand

Whether you’re embarking on a total rebrand or just looking to optimize existing assets, your branding strategy should be broken down into clear milestones.

Tip 1: Understand the Strict Regulations

2024 has seen huge changes in global finance regulations.

Here are some key global regulatory bodies your teams will need to be aware of:

- Basel III

- Financial Stability Board (FSB)

- International Organization of Securities Commissions (IOSCO)

- General Data Protection Regulation (GDPR)

- International Financial Reporting Standards (IFRS)

There are also varying bodies for each region too. For example, in the UK, you’ll need to be aware of the FCA, its crack down on greenwashing and strict social media guidelines.

In the USA, FINRA plays a huge part in ensuring that all marketing and branding communications are fair, balanced and not misleading.

To avoid a hefty fine or risk a bad reputation, your brand must monitor, adapt and comply.

Top Tip

Choose someone to monitor regulation changes so they can arrange training sessions that keep your teams compliant. Make sure you implement strict reviewal processes for new assets too.

Tip 2: Define Your Brand’s Mission

Before anything else, clarify your brand’s mission.

You’ll want a clear, concise mission statement that reflects your brand’s values, is backed up by excellent service, and resonates with your target audience.

Think about the following:

- What is the goal of your firm?

- What principles direct your decisions?

- What benefits do you offer to clients, partners and communities?

If you haven’t visited your brand’s mission in a while, organize a roundtable with stakeholders to brainstorm ideas and ensure you’re all aligned.

Make Sure to Evoke Emotion

Try to evoke emotion with your statement. No matter who the decision-makers are, people choose using emotions (even in financial services), so your firm’s mission should evoke positive emotions, such as feeling understood or listened to.

For example, HSBC’s mission is, ‘bringing together the people, ideas and capital that nurture progress and growth, helping to create a better world – for our customers, our people, our investors, our communities and the planet we all share’.

It’s actionable, outcome-based, and a strong statement that consumers can buy into emotionally.

Top Tip

Try to write your mission statement in one sentence. If you can’t, it’s probably too complicated.

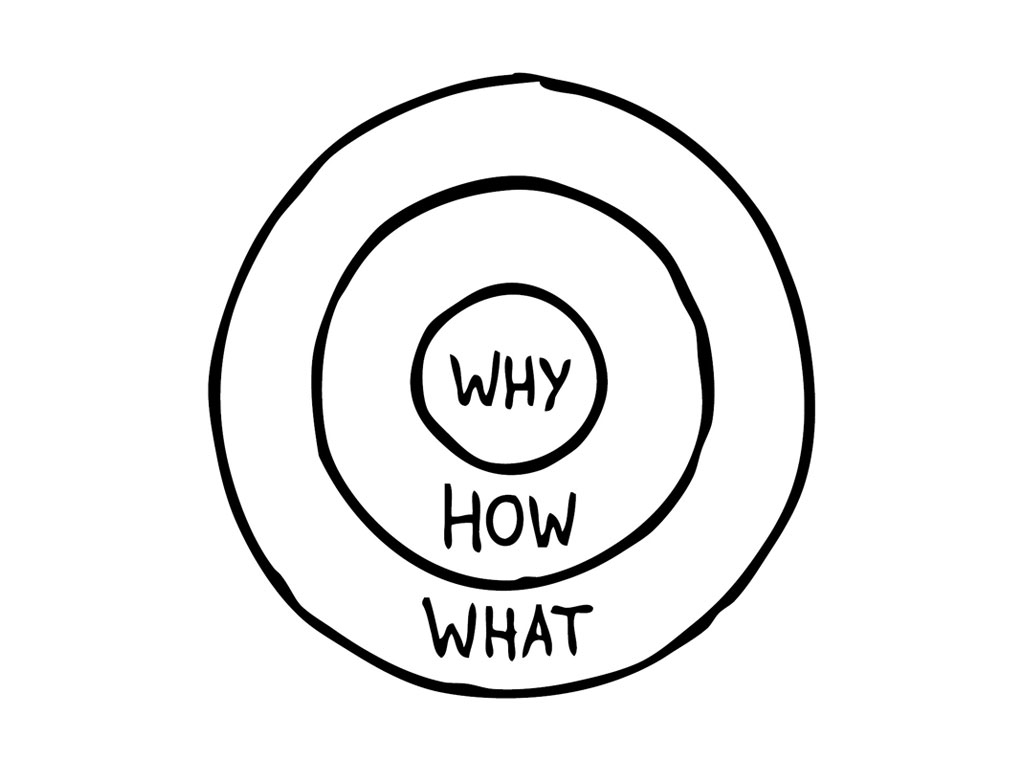

Use the Golden Circle of ‘Why’ exercise

You can also try using Simon Sinek’s “Golden Circle of Why”.

He highlights how brands can achieve so much more by asking a simple question—“why?” Making money isn’t a “why”, that’s a result. Your “why” is your purpose, cause or belief.

Circling back to HSBC’s mission statement earlier, their “why” is to help build a better future.

Using this example, think about how you can dig deep into the true purpose of your firm, evoke emotion and solidify your brand’s “why”. Don’t just communicate what you do, but “why” you do it.

Tip 3: Audit Your Financial Services Brand

A brand audit will identify areas of your brand that are working, where it can be improved, and provide actionable insights for mapping out your next steps. Many agencies can help you with this, but with the right resources, you can easily carry it out in-house.

Start With a Brand Audit Plan

Your plan should center around three key areas:

- External branding (to discover how it’s perceived in the market)

- Internal culture (to determine if your employees and investors align with your mission)

- Client experience (to uncover any potential misalignment with the brand)

Resources to get started:

- Look at our expert tips on auditing your brand

- Delve into our Financial Services Rebranding Toolkit

- Explore our in-house design services

Tip 4: Optimize Your Visual Identity

Your visual identity includes the following elements:

Logo

A strong logo should grab attention, be memorable, and communicate your brand’s values while maintaining professionalism.

Many legacy finance firms have retained their original logo to maintain the customer trust they’ve built over the years. However, we’re seeing traditional firms like Nationwide rebrand to a ‘fintech’ style logo that’s closer to the appearance of Monzo or Revolut.

By aligning with their brand identity of being a ‘dependable disruptor’, this bold move works perfectly. So don’t be afraid to disrupt the market with something new!

Learn about Nationwide’s new look.

Color Scheme

Trademark color palettes should include one main color and one secondary color for accents. Consider emotional triggers and how you want prospects, clients or stakeholders to feel.

Blue is a popular primary color that represents dependability, whereas black is commonly associated with premium, bulge-bracket financial services.

For example, firms like FORVIS and Mazars are bringing something new to the table with their new global network and rebrand: Forvis Mazars.

The new logo uses two shades of blue to reassure clients that the rebrand will serve them better, by providing clarity and building confidence.

Popular secondary colors in financial branding include grey, green and gold as they typically connote high profitability.

Singer Capital Markets chose a green color palette to convey its brand promise of trust, care, and results.

Typography

Your brand’s typography should be clear and easy to read. Establish one primary font and a few complementary secondary fonts that don’t overcomplicate your image.

Some popular fonts in financial branding include:

- Modern: Helvetica, Arial and Open Sans

- Traditional: Times New Roman, Georgia and Garamond

Top Tip

To truly differentiate your brand from competitors, consider investing in a custom typeface.

Tip 5: Ensure Brand Consistency at Every Touchpoint

Once your brand’s messaging and visuals have been defined, you need to ensure consistency across every touchpoint, including your website, emails, pitchbooks, IMs, reports and all client-facing deliverables. Consistent branding has been shown to keep customers loyal – and even a 5% increase in client retention could translate into profit increments of up to 25%.

Clients who don’t have a similar experience across all touchpoints with your brand can feel unsettled, confused and can easily lose trust.

How to Ensure Brand Consistency

Many leading financial firms, such as BNP Paribas, UniCredit, KPMG and Forvis Mazars, use UpSlide – a dedicated branding tool for financial services – to ensure their teams only ever use pre-approved, on-brand assets.

Want to learn more about brand consistency? Discover all you need to know about branding compliance.

Top Tip

Use Getty Images’ Brandguide to create a simple financial branding book with your newly established key guidelines.

Tip 6: Become a Thought Leader

Once the foundations are in place, let’s explore how becoming a thought leader in your field can bolster your branding strategy.

We’ll cover the most important channels for cementing thought leadership in 2025: content marketing, SEO, and social media.

Content Marketing

Create and distribute strong thought leadership content that demonstrates your firm’s unique stance, beliefs or future predictions based on independent research you’ve carried out. The end-goal is to become known as the go-to hub for financial services advice in your field.

You can publish:

- In-depth articles

- Whitepapers

- Research reports

- Industry trends

- Market analysis

For example, Deloitte publishes regular in-depth articles, such as ‘The future of AI in Banking‘, whilst HSBC publishes frequent global research reports to help deliver the best investment opportunities to clients.

Search Engine Optimization (SEO)

For SEO success, you must maintain this authoritative image and educational content on your website. But it isn’t as simple as publishing content; your content must be helpful to users.

Financial services websites fall into the Your Money or Your Life (YMYL) category, which means on-site content is held to a higher ‘page quality’ standard, as it can directly impact “the future happiness, health, financial stability, or safety of users.”

To check if the content is helpful, your team must put themselves in your target audience’s shoes and ask:

- Am I learning from this content?

- Would I want to bookmark this article?

- Would I want to share it with friends, family or colleagues?

These questions should be asked when auditing existing content or checking the quality of new pieces.

Social Media Presence

Use social media to distribute thought leadership pieces, share interesting industry trends, post about events your team has attended, and showcase your firm’s achievements, such as CIB league table rankings.

HSBC Innovation Banking is doing a great job of leveraging LinkedIn to enforce its brand’s thought leadership position and commitment to innovation.

Source: LinkedIn

Tip 7: Manage and Protect Your Reputation

To protect your brand’s reputation, you’ll need to ensure your teams can quickly identify early signs of a crisis, have the resources to respond immediately, and effectively work towards a resolution. The average cost of a damaged brand for enterprises costs $200,000 to repair, so don’t overlook this step!

Here’s an overview of how to protect your financial brand:

Crisis Management Plan

Ensure your brand has a crisis management plan outlining procedures, roles and responsibilities. This plan should cover all stages and types of crises—from financial and operational to reputational and regulatory.

Social Listening Tools

To react as quickly as possible, monitor the public perception of your brand with a social listening tool (such as Brandwatch) so your team can kickstart your crisis management plan immediately.

Tip 8: Offer an Exceptional Customer-Centric Experience

Financial firms who handle massive deals are experienced, knowledgeable and require a specialized approach to customer satisfaction. From a branding perspective, this should involve every touchpoint a client has with your firm—from pitchbooks, to emails, to business cards. Your deliverables should be flawless, error-free and on-brand.

Allocate Time into High-Value-Added Tasks

This high-quality service also needs to trickle down into all client-facing teams. Everyone at your firm should have enough capacity to not compromise on the quality of financial analysis or strategic thinking. They must also have enough time to focus on nurturing client relationships, such as taking them out for a meal or arranging regular check-ins.

To free up your team’s capacity, you could invest in technology that automates or speeds up low-value-added tasks, such as automatic query resolution using artificial intelligence and document automation software to reduce time spent on building reports.

The better quality service, the more trust clients will have in your brand.

Tip 9: Internal Alignment and Open Communication

Employees who are aligned with your identity make the best brand ambassadors.

To ensure your internal teams buy into the new identity, frequently communicate your brand values, mission, and vision to all employees. Use consistent branding in all internal communications and create a feedback loop so employees can share suggestions, ask questions, and get clarity if there’s anything they’re unsure about.

Adhering to strict brand guidelines helps instill pride amongst teams about being part of the entity they’re helping shape. This can directly influence employee morale, motivation, and overall satisfaction within your firm.

Giorgia Guantario

Interim Head of Marketing

Foster a Strong Company Culture

If your company’s culture has room for improvement, try to align key stakeholders on the importance of established values that employees can live by in their daily work. Here are some useful strategies to try.

Measure the Impact of Your Financial Branding

You can use many metrics to assess how successful your financial branding refresh or revamp has been, but here are a few of the most useful:

- Measure User Lifetime Value in GA4

- Look for increases in Direct traffic following a brand awareness campaign using GA4

- Conduct internal and external surveys to gain an understanding of how your brand is perceived internally (employees, stakeholders) and externally (clients, prospects)

- Monitor search volume data for your brand name using SEO tools, such as ahrefs

- Use social listening to track the usage of your brand’s name on social media, such as Hootsuite or Oktopost

- To measure the success of your branding internally, regularly review usage statistics of your new branding (such as branded templates, assets and e-mail signatures) through brand compliance software, such as UpSlide

Here’s more advice for measuring brand awareness.

Examples of Powerful Financial Brands

Now we’ve covered what you need to do, let’s look at examples of financial brands that have perfected their identity with these core ingredients.

Singer Capital Markets: Example of a Strong Identity

Singer Capital Markets is a leading investment bank with a strong heritage of over 100 years. With the help of UpSlide’s Design Studio, their brand was refreshed, modernized, and launched across the entire business—all while maintaining their four core values: integrity, partnership, excellence, and continuous improvement.

In 2021, N+1 Singer merged with another management company to become Singer Capital Markets. We were tasked with creating a corporate identity that would reflect the brand’s heritage by adding a modern twist while retaining its culture and values.

Amélie Pantaleone

Team Lead Design at UpSlide

Find out more about Singer Capital Market’s rebranding project

Partech: Example of Brilliant Financial Rebranding

Partech’s new bold identity draws inspiration from French cinema to beautifully align with its core values: independent thinking, collaboration, and responsible investing. The logo’s modern edge represents the firm’s mission to rapid technological advancement and forward-thinking.

“With our new visual identity, we’ve embraced a bright and dynamic look – one we believe is very much in line with the brilliance of our family and ecosystem.”

Philippe Collombel, Founding and General Partner at Partech, Partech

Helpful Resources

- 4 Mistakes to Avoid With Your Rebrand Rollout

- The Financial Services Rebranding Playbook

- All You Need to Know About Brand Compliance

Key Takeaways

These advanced strategies and tips will help you ensure regulatory compliance, build trust, and cut through that stubborn red tape.

By maintaining a consistent brand image, nurturing emotional connections, and investing in thought leadership and personalization, you can navigate the complexities of financial services branding and achieve sustained business success.

For help optimizing your identity or aligning multiple countries, watch our on-demand webinar, Rebrand into a Global Financial Powerhouse, for a deep dive into expert branding strategies backed up by real-world successes.

TL;DR

Large financial brands must have strong values and a clear mission statement with emotional triggers to help drive business growth.

There are strict global regulations in place that can impact financial branding, so your teams will need to monitor, adapt and comply to avoid hefty fines.

Key strategies include auditing your brand, optimizing or rebuilding your visual identity, managing online reputation, offering exceptional customer-centric experience and turning your employees into brand ambassadors.