Big data, data science, data-driven… these phrases have become part of our everyday vocabulary. Today, the widespread use of data makes it possible to accurately monitor changes in real time, a recent example being the WHO’s online dashboard which allows daily monitoring of Covid-19 figures.

The financial industry has always been data orientated, what with financial statements, stock market prices and macroeconomic statistics. Take asset management companies for example, who use data providers such as Bloomberg, Reuters, Factset or Morning Star and then extract and analyze the information in Excel.

However, due to the rapid growth in the sheer volumes of data to be analyzed, coupled with the need for automation, customization, and accessibility, an Excel worksheet is often no longer sufficient. It’s for this reason that many people are turning to platforms such as Power BI, which we’ll introduce you to in this article, along with some practical examples.

TL;DR

Power BI is quickly becoming the leading software for data visualization and analysis.

We cover three main use cases for Power BI in the finance industry: reporting, sales monitoring and cash control.

Discover a quick guide on how to transition to Power BI for your everyday work in the Microsoft 365 suite.

The Importance of Power BI

Today, Power BI – the data analysis software developed by Microsoft – already allows millions of users to create automated reports that can be accessed from any device. This business intelligence tool is designed for companies that need to track their key indicators and processes, and to analyze large volumes of data or share results in the form of secure online reports.

Over the past few years, there has been a growing interest in this software by organizations that are in the midst of digitalization: more than 150,000 organizations are now using Power BI!

The uses of Power BI are many and diverse. The strength of the platform lies primarily in its ability to cover the entire data processing cycle (collection-preparation-visualization).

The main advantages of the tool are:

- Ease of use for end users

- Aggregation of data from multiple sources

- Automatic consolidation of large volumes of data

- Updating and monitoring of indicators in real time

- Accessibility and security of information

So how is Power BI used in finance? What needs does it meet? And what are the benefits of implementing it? Discover how, and why, companies are adopting Power BI in three corporate case studies.

Power BI for Reporting Digitalization

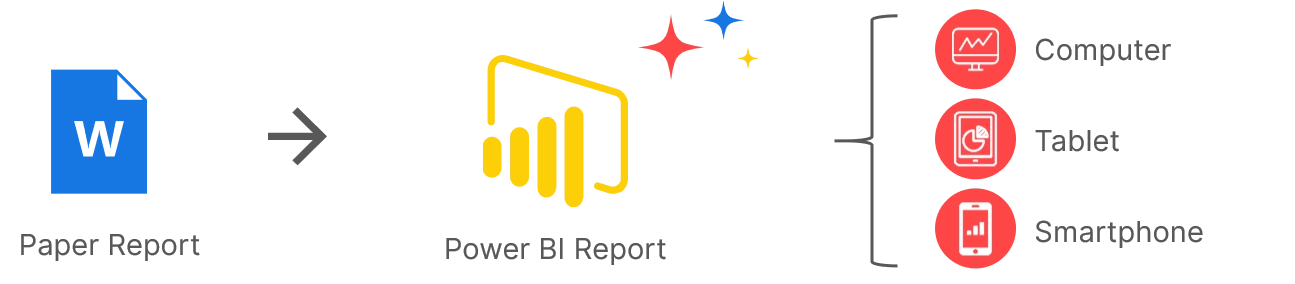

More and more financial teams are making progress with digitalization, starting with the automation of their reports, which they are transforming from the traditional paper format (initially Word or PowerPoint) to an electronic format, connected to their internal databases.

However, many large companies still consult their key figures on paper files. This was, until recently, still the case for the executive committee of a large energy group, whose members received a complete report in paper format before each of their biannual meetings. The constraints of this method quickly became apparent, as the complexity and comprehensiveness of the files made it difficult to analyze the firm’s performance over time.

The UK Group CEO launched the idea of a project which would allow everyone to benefit from a simplified macro view, with access at any time to the key figures of the group and its entities.

Power BI naturally emerged as the best solution to meet the Executive Committee’s expectations. A report compiling the company’s main performance indicators and also enabling them to be “filtered” by entity, country or type of energy was therefore quickly proposed to replace the old paper document.

Thanks to Power BI, the members of the Executive Committee can now look at the group’s updated figures at any time via a report which is:

- Dynamic: it updates automatically when new data is received or according to user-defined options.

- Shared: available online and accessible from a computer, tablet or smartphone.

- Ergonomic and easy to use: simple, intuitive and aesthetically pleasing.

Power BI for Real-Time Sales Monitoring

In addition to being able to directly connect to multiple different data sources, Power BI allows you to collate this data quickly, even when the data set is very large.

In the example of a famous ready-to-wear retailer, sales results were entered into a sales management system and then consolidated into an Excel file using heavy macros, which took about 15 minutes to execute. Updating this file on a daily basis was time consuming and the size of the final file made it impossible to share.

▶ See how to reduce your Excel file size

The company’s management soon started to consider replacing this system with a dynamic report, accessible to all and, above all, easy to understand for those who did not have a financial background.

The solution? An online Power BI report that automatically updates itself every morning and allows you to track sales data from several perspectives: geographic, brand, store, type of item sold, etc.

Here, Power BI proved to be the best solution because of its ability to process large volumes of data that change over time. Moreover, its dynamic and user-friendly design makes it a much more suitable consultation tool than Excel.

Power BI for Cash Control

Databases contain more and more sensitive information: customer data, bank details, accounting figures, etc. This information presents real strategic challenges for companies, which must ensure that these details are secure. To do this, several methods exist:

- Hosting the data on trusted, or internal servers (“on site”)

- Reduced human intervention to limit the risk of error

- Secure access to the resource (multi-factor authentication, network restriction, etc.)

- Adoption of secure tools for data visualization

A leader in the luxury goods industry was tracking its cash balances via Excel extracts that were manually collated by analysts before being returned to PowerPoint. Their main challenge was retrieving data from multiple media and systems – internal ERPs, platforms and external service providers. Although complex to process, this report is essential for them to determine the risks of payment default and to protect themselves against it with insurers.

This is why the group has opted for an automated and secure report of risk indicators (outstanding receivables, overdue receivables, unpaid receivables) – the accounting data must be correct and protected.

The introduction of the Power BI report has made it possible to question the methods and cleanliness of data extracted from several sources, in particular by removing manual reprocessing. In addition to cleaning and consolidating the information, they are displayed visually and are accessible to each department’s manager.

Finally, data security is guaranteed thanks to the ability to display data according to users (this is known as “line security”) and the ability to store data locally.

How to Transition to Power BI

Although dynamic reports are on the rise, companies still need to rework their data in Excel or present it statically in PowerPoint to focus on a specific time of year, a specific product or a particular region. This makes it possible to split the information to be shared into the most commonly used Office formats.

The finance industry uses the Microsoft 365 suite on a daily basis, so more and more people are looking to connect Power BI to the Office 365 suite to help them switch from a dynamic report to a static report in the blink of an eye.

In order to rework or present your Power BI data in Microsoft 365, here are some useful resources: