Accounting and Advisory firms face a number of challenges today: fiercer competition on deals, quicker turnarounds expected on RFPs, and higher expectations on document quality. Strategic growth fuelled by mergers is reshaping the landscape, and as a result, the Big Four (EY, KPMG, Deloitte, and PwC) are moving aggressively into the middle market, meaning smaller firms are often coming up against larger competitors.

UpSlide’s 2025 report, Accounting and Advisory in 2025: Forces Shaping the Competitive Landscape, utilizes survey data from 400 Advisory professionals outside of the Big Four and across the US and UK to uncover the key dynamics shaping the sector. Branding and software emerged as the two most urgent pressure points for Advisory houses of all sizes, yet how they’re impacted by these factors depends heavily on company size.

Here’s everything you need to know about the biggest challenges facing the Accounting and Advisory industry today – and how to future-proof your firm against them.

Your Brand Either Works For You or Against You

There are many powerhouse brands across the Accounting and Advisory sector, with the Big Four alone holding an estimated combined brand value of $111.6 billion (Brand Finance). According to McKinsey & Co., brand trustworthiness is becoming increasingly critical – with stronger brands consistently performing highly in the market. Regardless of size, your brand either works for you or against you; and our survey shows for many, it is the latter.

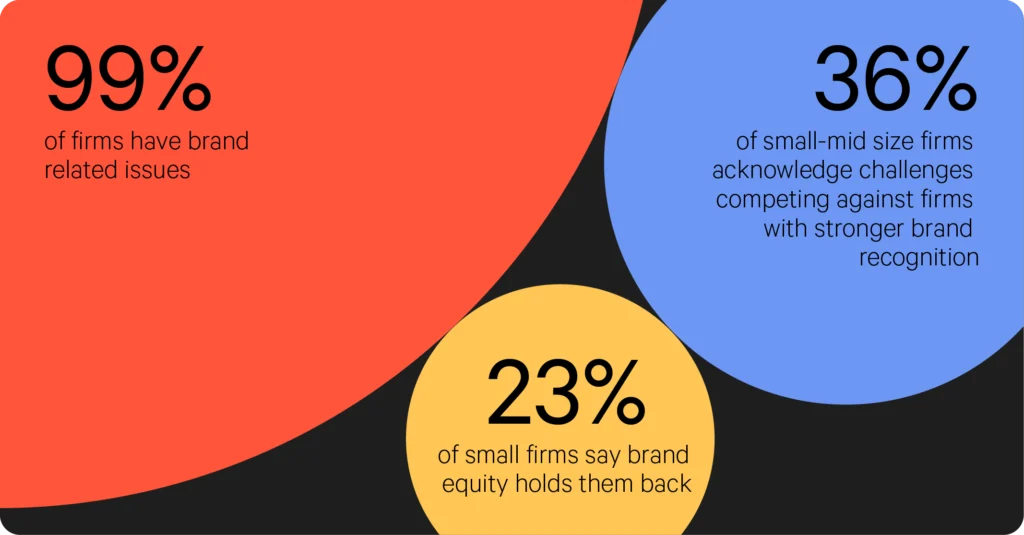

It’s easy to assume that in within Accounting and Advisory branding is a non-issue, especially at the larger end of the market. Yet, 99% of UpSlide’s respondents (including those with revenues of over $500M) recognize they have brand-related challenges. Brand reputation impacts everything from the perceived quality of work to client loyalty. So why aren’t firms prioritizing their brand more?

Branding Challenges In Advisory

36% of all respondents cited brand perception as a core issue when competing against bigger firms. However, this issue was more prevalent in firms with lower revenue rates; 60% of firms with revenue under $1M said they feel the most pressure when competing with larger rivals with more well-known brands.

For large firms (5,000+ employees), inconsistent branding was the top concern (42%). This comes as no surprise: managing multiple offices and departments complicates brand governance. Plus, with M&A activity rising across the sector, 17% of respondents cited acquisitions as a key strategy to remain competitive, brand cohesion is increasingly at risk as multiple firms unify under one brand. However, branding isn’t the only challenge facing growing firms – only 27% of large firms are confident their deliverables support, rather than hinder, competitiveness.

While the challenges are clear, there are also practical steps firms can take to turn their brand into a competitive asset.

Expert Tips to Strengthen Your Brand Identity

Companies that excel in brand reputation treat it as an organization-wide responsibility not just marketing’s. It starts with high-quality, consistent websites, pitches, and client deliverables. Standardized processes and branding compliance and automation tools make a real difference here.

But a brand truly comes to life through client-facing employees. Ensuring they understand and embody the brand is essential. Regular brand audits and reviews keep teams connected to the front line.

Simone Lilley

Head of Marketing

Why Software Spend Isn’t Paying Off

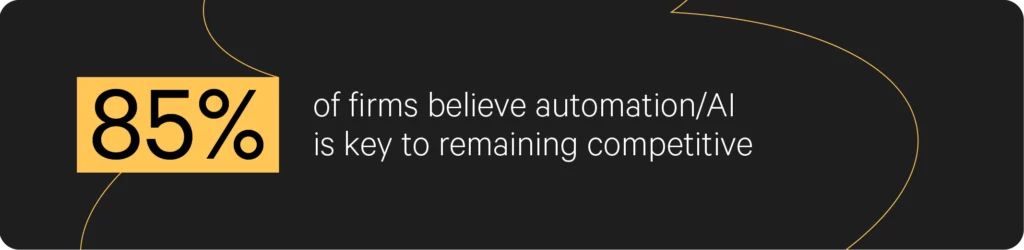

Technology has transformed Accounting and Advisory services over the past two decades and is now a core driver of competitiveness. UpSlide’s deep dive into Accounting and Advisory revealed that 85% of firms see AI/Automation as essential to remaining competitive, and 98% believe failing to invest in AI/Automation software carries a significant risk.

Despite this awareness, a gap remains between investment and practical usage. While 98% of firms have some form of document automation, only one-third report full adoption, and one-quarter say usage is minimal or non-existent. The message is clear: buying the tech is not enough. Success hinges on choosing the right tools and embedding them into day-to-day workflows.

Implementation Challenges Across All Firm Sizes

Across firm sizes, 34% of respondents reported challenges with past technology implementations. UpSlide’s survey respondents highlighted three key barriers that have caused document automation tools to go unused:

- A lack of effective training (60%)

- Tools that don’t address core pain points (48%)

- Tools are not user-friendly (43%)

All of these factors have the potential to result in low software adoption and growing issues such as tech debt, which are critical concerns in Accounting and Advisory that, if ignored, can cause financial losses and reduced efficiency.

Smaller Firms are Held Back by Budget Constraints

Small firms (250–1,000 employees), face their own set of challenges. 35% of small firms identified budget as their primary obstacle to successful tech implementation. With fewer resources for experimentation, they must be strategic in selecting and onboarding technology that delivers immediate value. This is becoming increasingly important as competition with larger advisory firms looms large.

Fragmentation Risks in Medium and Large Firms

Medium (1,001–5,000 employees) and large (5000+ employees) firms face different issues. 60% of firms with revenue over £500 million said their current tech stacks are not meeting business needs. Additionally, 17% reported that prior implementation issues have made securing buy-in from senior leadership more difficult. As firms grow, fragmented, siloed systems often take root, reducing efficiency and slowing decision-making processes.

Without addressing these areas of concern, even significant software investments risk delivering minimal value, leaving firms exposed at a time when operational efficiency is more critical than ever. Firms that delay or rush software investment risk falling behind: 41% of mid-sized firms directly linked recent deal losses to weaknesses in their technology infrastructure.

Expert Advice to Strengthen Your Tech Strategy

To successfully onboard and implement AI/Automation software, it is critical to:

- Identify key pain points in workflows and select tools that solve these vital challenges

- Ensure new technology interfaces with existing and planned IT infrastructure

- Review tech usage regularly to avoid tech debt and maintain performance

- Provide thorough, ongoing training to boost adoption

By doing so, firms can successfully integrate new tech, reduce risks, and stay ahead of the competition in an ever-changing market.

Will Barry

Principle Product Marketing Manager

Key Takeaways

Accounting and Advisory Firms that overlook the risk of not investing in their brand and the right software face slow, compounding damage, from lost deals to diminished client trust and operational inefficiencies.

The good news? Getting the basics right has a greater impact than most realize. Rather than complex tech stacks and fragmented brand identity, focus resources on strong, consistent foundations such as high-quality deliverables and selective automation software.

Firms that strengthen their brand, invest wisely in technology, and embed it into daily operations will be best positioned to lead the market.

Download the report Accounting and Advisory in 2025: Forces Shaping the Competitive Landscape to read the complete insights.

TL;DR

- Inconsistent branding and underused automation tools are two of the biggest challenges facing Accounting and Advisory firms in 2025.

- Smaller firms lack brand visibility and face tighter tech budgets, while larger firms struggle with fragmented branding and siloed systems.

- Firms that build brand consistency, choose tools strategically, and embed them into daily workflows will lead the market.

- Act intentionally and review regularly, or risk falling behind.