Tendances dans la banque d'investissement : Défis et perspectives en matière de logiciels

Découvrez des idées, des défis communs, des tendances émergentes et des stratégies exploitables pour naviguer dans les dépenses en logiciels dans les banques d'investissement.

En partenariat avec :

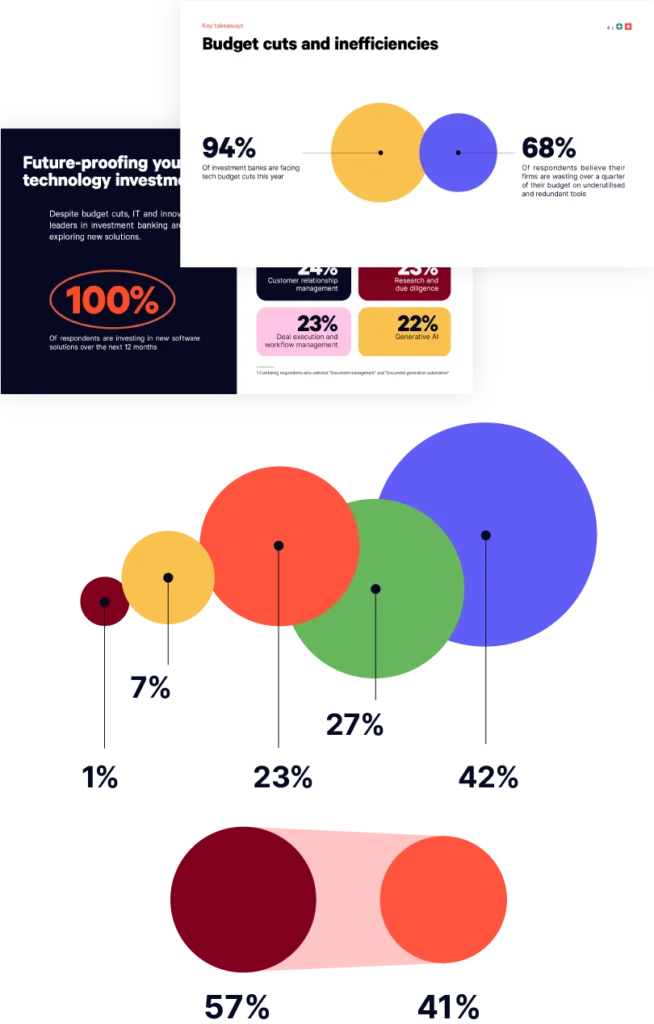

Les banques d'investissement s'efforcent de faire face aux restrictions budgétaires

Les banques d'investissement se trouvent à un tournant.

D'une part, les banques qui ont adopté les nouvelles technologies ont vu leurs performances et leur rentabilité s'améliorer considérablement. D'autre part, les réductions budgétaires et l'inefficacité se profilent à l'horizon, de nombreuses entreprises gaspillant une part importante de leur budget logiciel dans des outils redondants et sous-utilisés.

Notre "Investment Banking Software Report 2024" explore les questions critiques auxquelles sont confrontées les banques d'investissement aujourd'hui, notamment :

- Quelles sont les solutions Saas qui apporteront le plus de valeur à long terme ?

- Quels sont les facteurs à prendre en compte lors de l'évaluation des fournisseurs de logiciels ?

- Comment les entreprises peuvent-elles mesurer avec précision le retour sur investissement ?

Plongez dans le rapport pour découvrir des informations et des stratégies exploitables pour vous aider à prendre des décisions éclairées et à optimiser vos investissements technologiques.

Les tendances de la banque d'investissement pour 2024 : Principales conclusions du rapport

Les logiciels sous-utilisés grèvent le budget des banques

Plus de deux tiers des personnes interrogées estiment que leur entreprise gaspille plus d'un quart de son budget dans des outils sous-utilisés et redondants.

Les investissements dans les logiciels bancaires ne ralentissent pas

Tous les répondants investissent ou investiront dans de nouvelles solutions logicielles au cours des 12 prochains mois.

Tendances en matière d'achats de logiciels : les préférences évoluent

La création de logiciels en interne n'est plus l'approche préférée des banques d'investissement, plus de la moitié des personnes interrogées déclarant qu'elles préfèrent les acheter.

L'automatisation et la gestion des documents sont la priorité

L'automatisation et la gestion des documents figurent en tête de liste des priorités d'investissement pour la majorité des entreprises, qui s'efforcent de plus en plus d'accroître l'efficacité de leurs activités.

L'adoption effective et la gestion du changement sont essentielles pour générer de la valeur logicielle

Les banques qui dépensent plus de la moitié de leur budget déclarent qu'une formation interne insuffisante et une gestion inefficace du changement entravent l'adoption.

Les banques d'investissement sont de plus en plus contraintes de choisir le bon fournisseur de logiciels

Bien qu'il y ait des différences entre les zones géographiques, des mesures claires du retour sur investissement sont le seul attribut commun sur les listes de souhaits des fournisseurs.

Webinaire : Obtenez un retour sur investissement de votre stratégie logicielle : Les points de vue de Lazard et Nomura

Découvrez comment vos pairs de la banque d'investissement maximisent leurs dépenses SaaS cette année, en choisissant les logiciels qui ont le plus d' impact sur les résultats et en obtenant l'adhésion de l'ensemble de l'entreprise.

Majhon Phillips, responsable des services professionnels en Amérique du Nord - UpSlide

Christina Maddy, directrice exécutive de l'innovation numérique de la banque d'investissement - Nomura

Ian Clark, responsable mondial de la technologie - Lazard

Ed Rassmussen, Vice-président exécutif mondial - Williams Lea

Logiciel de banque d'investissement 2024 : Défis, tendances et stratégies

Téléchargez le rapport pour obtenir un accès exclusif à des informations sur la façon dont les banques d'investissement mondiales envisagent leurs dépenses en logiciels en 2024 et au-delà.

Découvrez d'autres informations sur la banque d'investissement

Une meilleure façon d'élaborer des documents et des pitchbooks

Les études montrent que les principaux facteurs qui entravent la valeur générée par les dépenses en logiciels des banques d'investissement sont une formation et une adoption insuffisantes, une gestion du changement inefficace et des processus de déploiement inférieurs aux normes.

Chez UpSlide, nous pensons que votre entreprise mérite des solutions qui seront utilisées efficacement par vos équipes pour travailler plus efficacement et créer des livrables gagnants pour votre entreprise. C'est pourquoi nous travaillons en étroite collaboration avec vous, non seulement pour aider vos équipes à créer plus rapidement de meilleurs documents, mais aussi pour garantir un retour sur investissement optimal.

Calculateur de retour sur investissement

Découvrez la valeur que vous pouvez retirer de UpSlide.

Prêt à déployer enfin une solution de productivité qui apportera une véritable valeur ajoutée ?

Nous serions ravis de discuter avec vous sur comment aider votre entreprise à mettre en place une solution d'automatisation et de gestion des documents qui soit réellement appréciée et utilisée par l'ensemble de vos équipes. Remplissez le formulaire et un membre de notre équipe vous contactera rapidement.